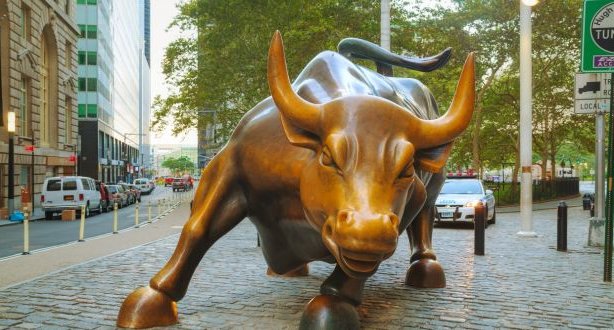

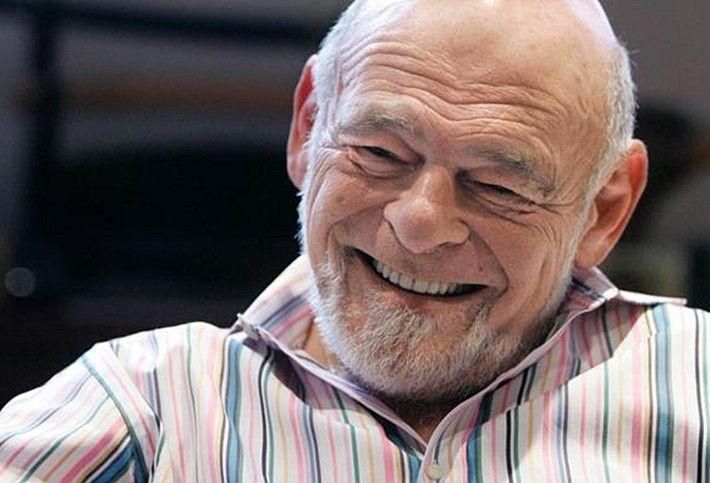

Billionaire Sam Zell sees ‘irrational exuberance’ in the stock market and he holds mostly cash. There is a dash out of risk assets and it appears to be gaining momentum amongst the smart money investor crowd.

“This seemingly unstoppable stock market rally is based on emotions not fundamentals” said Sam Zell. “I think the current situation seems like irrational exuberance” reiterated Sam Zell.

Indeed, this negative divergence between fundamentals and stock price is currently playing out and it is often interpreted as a sell signal for traders and investors.

But the “irrational exuberance” that Sam Zell sees in stocks has been egged on by the Fed’s (and its allied central banks) unprecedented monetary easing policy. Approximately, 12 trillion dollars of liquidity through the central bank’s asset purchase program, known as quantitative easing (QE) has been injected into the financial system since the 2008 financial crisis.

“This seemingly unstoppable stock market rally is based on emotions not fundamentals”

SAM ZELL

So we have had the longest (QE induced) secular bull rally in living memory. This irrational exuberance is courtesy of the central bank’s QE punchbowl.

Moreover, the new Fed chair Jeromy Powell although leaked Fed minutes show Powell to be uneasy with QE when Powell at the helm was put on the spot last week (Dow was about to enter a bear market following negative economic data) the new Fed chair most probably decided to inject more QE. Stocks then rallied off their lows. Another QE induced rally?

But what about the new business-friendly Trump administration which is pushing through tax reforms and deregulation does Billionaire Investor Sam Zell still see ‘irrational exuberance’ in stock?

On this front, Sam Zell is less downbeat and believes that the pro-business Trump administration is starting off on the right footing.

Sam Zell says he does see a path to increased economic growth due to tax reform and deregulation policies of President Donald Trump.

“This seemingly unstoppable stock market rally is based on emotions not fundamentals”

SAM ZELL

“I think the opportunity for the country to grow at 3 percent is real” but whether that happens remains to be seen, said Sam Zell, who has described himself as socially liberal and fiscally conservative. Indeed, January’s retail sales decline of 0.3% and CPI jump of 0.5% inflation data suggests a worse case scenario could play out, stagflation.

Nevertheless, economists in January’s CNBC/Moody’s Analytics Survey increased their median fourth-quarter growth forecast on Friday by 0.4 to 3 percent.

If their bullish view plays out then that would make three-consecutive quarters of 3 percent growth, a goal of the White House. However, skeptics of the Trump plan doubt whether that type of economic activity can take hold long term.

“I think the opportunity for the country to grow at 3 percent is real” – Sam Zell

Referring to asset prices Sam Zell reiterated, “I think the current situation seems like irrational exuberance,” said the founder and chairman of the property specialist firm Equity Group Investments.

Stocks prices have got ahead of themselves. Stocks are overpriced by whatever matrix you use, argues Sam Zell.

“I think the current situation seems like irrational exuberance” he reiterated.

“All assets, including stocks and property values, are too expensive” said Sam Zell.

“Tech stocks and other high-flyers, have been largely responsible for the rally” he said in a “Squawk Box” interview. Meanwhile, returns have been rather tepid added Sam Zell.

So where is Sam Zell parking his funds?

“I am largely in cash” said Sam Zell. That sounds like a typical billionaire value investor play, wait on the sidelines patiently for the next crash then snap-up value assets on the dollar.

With regards to real estate Sam Zell, said he has been “selling stuff”. With a dearth of investment opportunities, he argued, the burden of holding cash is not as great as it would be otherwise.

“All assets, including stocks and property values, are too expensive” – Sam Zell

The billionaire property investor has a knack for being ahead of the market. House prices are falling everywhere. In the UK the average price of a home fell by 0.6% to £225,021 in December, according to Halifax. London home prices, south, and west saw some of the biggest drops.

Typical prices in prime central London ended 2017 down 4% for the year as a whole, but prime south and west London experienced a bigger annual fall of 4.2%

Across the pond, New York real estate has it worse quarter in 6 years.

Moreover, in Australia Sydney property prices are tipped to fall 10% in 2018.

and many believe that property prices have reached a peak in Japan Tokyo.

So billionaire Investor Sam Zell sees ‘irrational exuberance’ for both stock and real estate hence he is battening down the hatches and piling into cash.

Sure, being liquid in a downturn is king but not always particularly if Peter Schiff’s extreme view that we are near the endgame actually plays out.

What do I mean?

Step into the time machine and transport yourself to Germany during the Weimar Republic years of hyperinflation. Germany’s monetary authority also believed they could print currency and get themselves out of an economic downturn. But they got it badly wrong. Does this all sound eerily familiar to current times?

The picture here is an example of what happens when central banks recklessly create currency without much forethought. German banknotes in 1923 lost so much value that they were used as wallpaper.

Think about it. if we are sprinting towards another currency crisis. What would you rather own a fist full of currency or an ounce of gold or maybe a machine that can produce valuable goods, or a valuable commodity, or medicine or anything with real tangible value?

Will insane ‘irrational exuberance’ bring investors back (abruptly) to good old fashion value investing?