There have been some changes to the World Top Investors profiles.

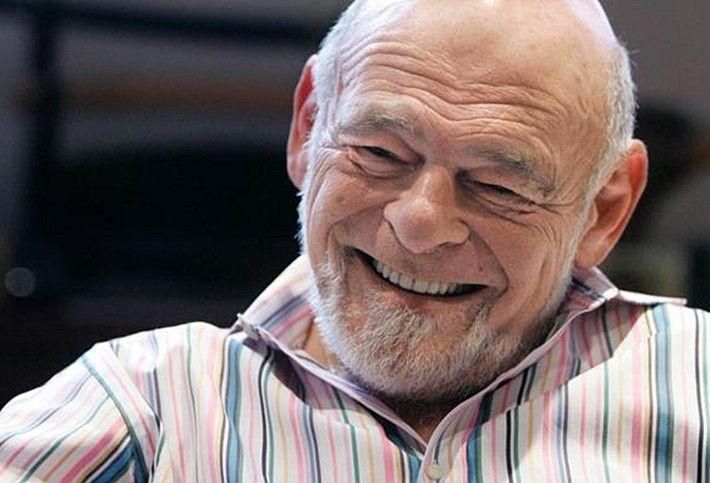

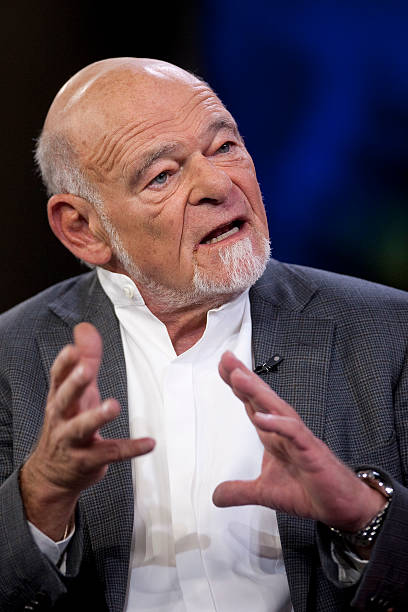

Sam Zell, one of the most outspoken and authentic investors on Wall Street has died at age 81.

Sam Zell, entrepreneur, investor and real estate mogul, acquired the nickname, grave dancer for his bets on distressed real estate assets.

His business investing career had its ebbs and flows, and with a string of wins, he managed to accumulate a personal net worth of 5.1 billion dollars.

Sam Zell was born in Chicago. He was the son of Polish Jewish immigrants who fortunately escaped the German invasion of Poland in 1939 and immigrated to the US. His father was a successful grain trader.

Bloomberg wrote in its obituary the following of the billionaire; “Zell cut an elfin figure and cultivated a rebellious persona, with displays of salty language, a penchant for motorcycles and frequent media appearances. The Chicago-born son of Polish refugees, he built a fortune in real estate and a hodgepodge of investments that included radio stations, drug stores, parking lots, mattresses and Schwinn bicycles,”

Sam Zell was a market-driven colourful character.

His last dance parting words, “Be a risk taker. However, define risk in your own terms.”

Michael Burry will be a new addition to the World Top Investors profiles

Michael Burry was born in San Jose, California June 19, 1971.

At age two, he lost his left eye to eye to retinoblastoma and has had a prosthetic eye ever since.

His call to fame and fortune was to be the first investor to predict and profit from the 2007 and 2010 subprime mortgage crisis.

Michale Burry studied economics and pre-med and earned an MD degree from the Vanderbilt University School of Medicine, and started but did not finish his residency in pathology.

While off duty Michael Burry worked on his hobby, investing.

Success at stock picking, value investing and then forecasting and profiting from the subprime crisis is why we are adding Michael Burry to our WTI profiles

His investment style is based upon Benjamin Graham and David Dodd’s 1934 book Security Analysis: “All my stock picking is 100% based on the concept of a margin of safety.

In 2005, Michael Burry focused on the subprime market. Through his analysis of mortgage lending practices in 2003 and 2004, he correctly predicted that the real estate bubble would collapse as early as 2007. His research on the values of residential real estate convinced him that subprime mortgages, especially those with “teaser” rates, and the bonds of these mortgages, would drop in value when the original rates were replaced by much higher rates, often in as little as two years after initiation. Micheal Burry decided to short the subprime market, which made him a personal net fortune of 100 million US dollars.

Michale Burry has had his share of wins and losses, like most WTI profiles. In May 2021, he held puts on over 800,000 shares of Tesla. In October 2021, after a 100% rise in Tesla’s stock value.