Lord Jacob Rothchild’s viewpoint barely got a cursory mention in the mainstream, which is somewhat odd bearing in mind that the Rothschilds are one of the most established and prominent banking families in the old world, Europe.

To get a handle on the latest Jacob Rothchild’s viewpoint you would need to tune into the family’s RIT investment company latest financial report

A year to date Lord Jacob Rothchild’s words of caution spelled risk-off for investors.

“We continue to believe that this is not an appropriate time to add to the risk”, wrote Jacob Rothchild in last year’s financial report.

“We continue to believe that this is not an appropriate time to add to the risk”

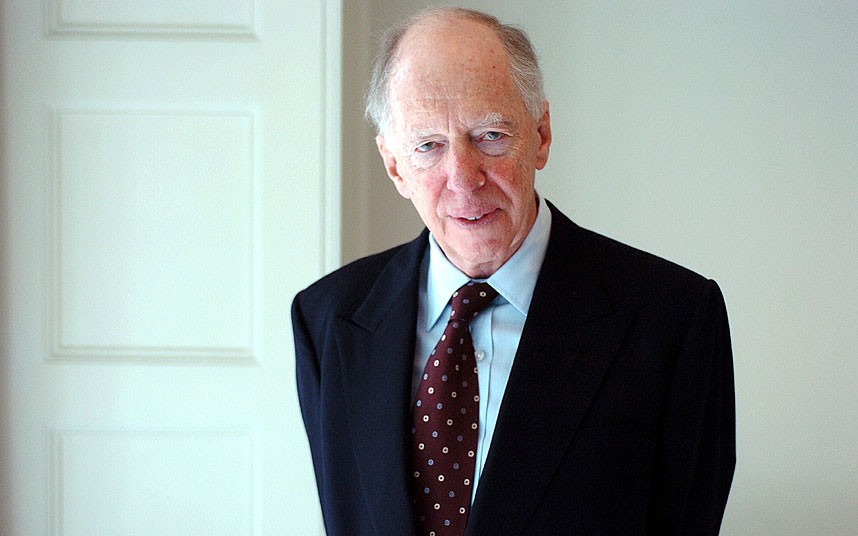

LORD JACOB ROTHCHILD

While the deteriorating macro data and lackluster corporate earnings would indeed support Jacob Rothchild risk-off sentiment stock markets continue to rally into the abyss.

Here is what Jacob Rothchild, Chairman of RIT Capital Partners plc had to say in March for the firms published results for the year ended 31 December 2018.

“2018 was the most difficult and treacherous year for investors since 2008, with negative returns in all major asset classes. In this context, we are pleased to be able to report that we delivered on our primary long‐term aim of preserving shareholders’ capital, with an increase of 0.8% in your Company’s net asset value per share (including dividends),” wrote Jacob Rothchild.

The best clue to Jacob Rothchild’s viewpoint going forward came in the next paragraph

“We were able to deliver this return in part by having reduced quoted equity exposure in advance of the fourth quarter which saw global equity indices fall by13%”.

“2018 was the most difficult and treacherous year for investors since 2008, with negative returns in all major asset classes”

LORD JACOB ROTHCHILD

Jacob Rothchild’s viewpoint is in tune with those investors who see elevated risks in buying assets that are in a price bubble

“The dangers of holding assets inflated by low-interest rates and quantitative easing are now visible to all. Throughout the year, therefore, we managed our asset allocation to keep net quoted exposure towards the lower levels of our historical ranges with higher levels of cash than usual,” added Jacob Rothchild’

In other words, Jacob Rothchild does not believe that there are any bargains in this financial market and he is waiting patiently on the sideline in cash to pounce when the next possible crash plays out.

Jacob Rothchild’s viewpoint now supports the school of thought that we are in the everything bubble courtesy of the central bank’s massive monetary easing policy.

“In the current year stock markets have, so far, shown significant gains. We remain however cautious about future prospects for markets, concerned over the accumulation of downside risks” – Lord Jacob Rothchild

Jacob Rothchild’s viewpoint, which errs on the side of caution, suggests that future monetary easing could experience the law of diminishing returns

“In the current year stock markets have, so far, shown significant gains. We remain however cautious about future prospects for markets, concerned over the accumulation of downside risks” he wrote.

But surely downside risk can be combated with the central bank’s massive monetary easing policies, as it did in the last crisis, which Jacob Rothchild previously referred to as “the greatest monetary policy experiment in the history of finance”.

Don’t bet on quantitative easing QE, which entails the central bank pumping liquidity into the system by purchasing financial assets, to come to the rescue in the next financial crisis

Not too long ago I wondered whether the central bank’s monetary easing policy could also be subject to the law of diminishing returns.

Now this dire view for fiat debt-based money is filtering through the mainstream.

A recent piece in Market Watch entitled, “Easy-money policies are sweeping the globe — one big problem: they’re losing potency” notes that global central bankers are confronting a nettlesome of problem. Moreover, any attempts to stimulate the economy is proving increasingly less effective, argues Torsten Slok, chief economist at Deutsche Bank Securities in a recent report titled “QE no longer works”.

Jacob Rothchild’s viewpoint is one of much downside risks

“Global economic growth is declining with the IMF having further reduced its forecasts.

The weakest Chinese GDP growth in nearly three decades is clearly having an impact on other regions, while German manufacturing output has contracted for the first time in four years. The most recent retail figures in the US lead on to believe that the economy will find it difficult to repeat last year’s fiscal‐fuel led results,” wrote Jacob Rothchild.

With respect to the geopolitical situation, “the geopolitical risks have not subsided” he added.

“We are surely witnessing the worst political situation in the United Kingdom since the Suez crisis” – Lord Jacob Rothchild

Jacob Rothchild’s viewpoint regarding Britain is neither comforting

“We are surely witnessing the worst political situation in the United Kingdom since the Suez crisis” wrote Jacob Rothchild.

“While social unrest and populism in a number of European countries cloud the future.We, therefore, anticipate a continuation of heightened market volatility. In these circumstances, capital preservation will remain as high a priority as any in the management of your Company’s interest,” wrote Jacob Rothchild.

This will be the last of Jacob Rothchild’s viewpoint as chairman of RIT Capital Partners

The 82-year-old legendary investor has recently announced that he will stand down after more than three decades as chairman of RIT Capital Partners.

Jacob Rothschild, the Chairman, transferred 48,544 shares in the company on the 17th June 2019 at a price of 0.00p, according to company filings.

Jacob Rothchild insisted that he would continue to play an “ongoing and active” role at the £3.2 billion investment trust.

Jacob Rothchild will be succeeded as chairman by Sir James Leigh-Pemberton, 62, the former chief executive of Credit Suisse in Britain and chairman of UK Financial Investments.