James Simons goes overweight in Tesla stock in the fourth quarter of last year, as the electric-vehicle maker’s shares catapulted higher, according to recent filings.

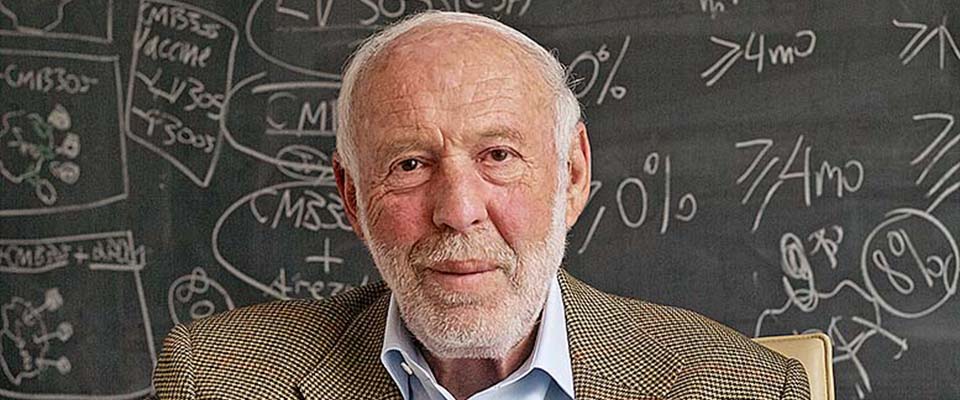

James Simons is a quantitative investor and founder of Renaissance Technologies, a private hedge fund based in New York City.

Financial Times in 2006 referred to James Simons as “the world’s smartest billionaire”. His current net worth is $18 billion, which makes him a member of the “propeller set”.

“the world’s smartest billionaire”

JAMES SIMONS

The so-called “smart money” James Simons goes overweight in Tesla stock as the electric-vehicle maker’s shares took a moon shot in the first quarter of 2020

James Simons, considered to be among the best quantitative-driven investor, owned 3.9 million shares of Tesla at the end of December 31, with the company’s stake in Renaissance’s portfolio jumping from 0.1% in the prior quarterly period to 1.3%.

The Tesla stock chart shows a sexy escalator climb as the billionaire quantitative investor James Simons rides the stock peak to 969 USD.

No doubt Telsa’s stock spectacular climb, in the first quarter of 2020, was fueled with burning bear traders, a classic short squeeze as less fortunate investors mistakenly bet on Telsa’s imminent demise. Indeed, several shorters were betting that lon Musk-run Silicon Valley darling would see its price collapse soon. Instead. the market surprised and Tesla’s shares have surged 142% in the past three months and have more than doubled since the beginning of 2020, according to FactSet data.

“The Tesla stock chart shows a sexy escalator climb as the billionaire quantitative investor James Simons rides the stock peak to 969 USD”

THE WEALTH TRAINING COMPANY

Ignore the news just look at the charts?

With James Simons overweight in Tesla’s stock one wonders whether this is impeccable timing or the benefit of propeller setting around with extremely well-connected crowd and hearing things on the grapevine.

All envy aside, perhaps a diligent student of technical analysis would have spotted Telsa’s buy opportunity well in advance.

“Tesla’s revenue in 2020 is expected to rise by 30.3% to approximately $32 billion, and earnings are forecast to rise to $8.68 per share from $0.20 per share in 2019” – The Wealth Training Company

James Simons overweight in Tesla stock underscores the company’s potential

Tesla completed a $2 billion secondary offering on Friday and analysts have continued to hold a bullish view on the company. Bernstein analyst Toni Sacconaghi nearly doubled his price target, describing the vehicle maker as the “ultimate ‘possibility’ stock.” The Bernstein analyst has since raised his price target to $730, which was still below current levels at $845, from $325. Moreover, Tesla’s revenue in 2020 is expected to rise by 30.3% to approximately $32 billion, and earnings are forecast to rise to $8.68 per share from $0.20 per share in 2019, according to Whalewisdom researchers.

James Simons overweight in Tesla stock should come as no surprise as the snapshot fundamentals look bright

But in these challenging times, that too could all change, so keep your optimism in check.

Meanwhile, another big player has pounced on Tesla’s stock.

JPMorgan Chase & Co. JPM was seen purchasing roughly 2.2 million shares of Tesla bringing its position to 2.5 million, according to Whalewisdom data.