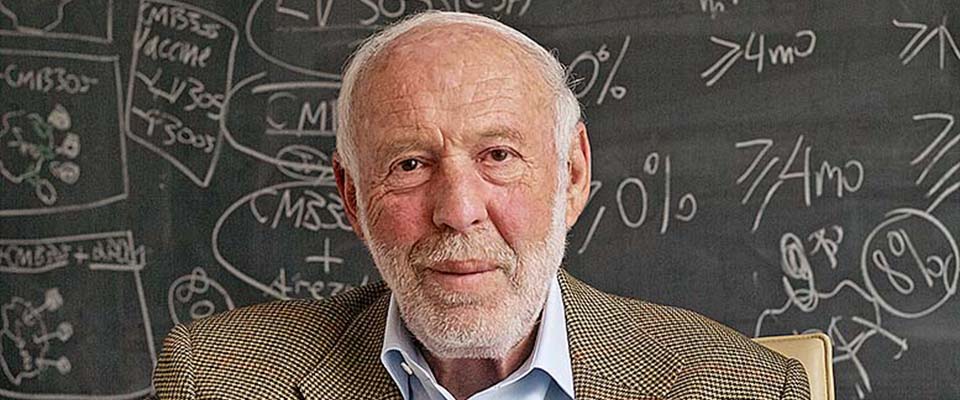

James Simons Renaissance alpha returns of 1.6 billion USD in 2018 has earned the hedge fund billionaire the heavyweight champion of the world’s most profitable hedge fund.

James Simons, a mathematical boffin and former cold war codebreaker sits at the top of the list of the hedge fund titans.

“James Simons Renaissance alpha returns of 1.6 billion USD in 2018 has earned the hedge fund billionaire the heavyweight champion of the world’s most profitable hedge fund”

James Simons Renaissance alpha returns also defies the market gloom experienced in 2018 which was a tough time for most international stock funds

The past year saw investors lament that there was “nowhere to hide” as asset classes across the board came under pressure. No matter the investment, “investors likely experienced declines in annual returns. Declines were seen in bonds, gold, oil, preferred stocks, and US equities, along with developed international and emerging market indices” said Sam Stovall, chief investment strategist at CFRA.

The chart here courtesy of Market watch illustrates the challenging investing climate in 2018

James Simons Renaissance alpha returns were made despite the Fed’s quantitative tightening and rate hikes in 2018

Monetary policy normalization would have meant the end of the longest bull market in history. Moreover, typical funds would have compounded their losses in 2019. So faced with a potential multiple bubbles burst in assets classes across the spectrum the Fed blinked, implemented a U-turn in monetary policy and the surreal bull market continued. Fantasy has become a reality for now at least.

“investors likely experienced declines in annual returns. Declines were seen in bonds, gold, oil, preferred stocks, and US equities, along with developed international and emerging market indices”

SAM STOVALL

James Simons Renaissance alpha returns underscores the fact that a few hedge funds are still able to generate profits even when a bull market goes cold turkey due to a lack of monetary stimulus

In other words, the transition of the Fed’s monetary policy last year created volatility waves, James Simons was able to forecast volatility a year ago, adjusted his portfolio accordingly and ride out the volatility waves to 1.6 billion USD in earnings. For those with means and know-how surfing market volatility could be one of the most profitable businesses on the planet.

Could interest in quant funds be spurred on by James Simons Renaissance alpha returns?

A casual perusal of the hedge fund titan list reveals that hedge funds with a quant fund strategy dominate the top five on list which can be viewed here.

A hedge fund with a quant fund strategy is an investment fund which selects securities using advanced quantitative analysis.

Quant funds are characterized by their reliance on algorithmic or systematically programmed investment strategies. Quant funds are usually staffed with geeks with academic degrees and technical experience in mathematics and programming.

In other words, a few talented humans write the programs and the computers do the trading. James Simons Renaissance workforce probably consists of more computers than humans.

“We could also be seeing the “Amazon effect” in the world of investing too with spectacular (and to some extent demoralizing) implications for human traders/investors”

James Simons Renaissance alpha returns is also a story about the rapidly becoming obsolete human versus the bot trader

We could also be seeing the “Amazon effect” in the world of investing too with spectacular (and to some extent demoralizing) implications for human traders/investors.

Is the future of business not only wireless but also fully automated, where a few near obsolete humans keep watch of the super workforce, of robots and computers beavering away for their capitalist masters?

AI, where programs will write their own programs, bots rebuilding bots could make humans redundant in a modern economy. The fourth industrial revolution is already underway. Meet tomorrow’s super worker that requires no healthcare or pension contributions, works 24-7 on demand, doesn’t have temper tantrums, ask for holiday pay, go on strike, form unions or ask for a pay rise. A capitalist wet dream has become a reality. See inside the Japanese hotel staffed by Robots here.

But in hot pursuit of James Simons’s Renaissance alpha returns of 1.6 billion USD earnings (and a celebration of people versus machine) is Ray Dalio’s Bridgewater with an impressive 1.26 billion USD earnings in 2018.

Again, Stella results during a period where most international stock funds experienced declines in that very same year.

Ray Dalio’s Bridgewater is the world’s second most profitable hedge fund. Unlike James Simons Renaissance quant fund Ray Dalio’s Bridgewater uses a global macro strategy to generate alpha returns.

“Ken Griffins, Citadel held the third place

with 870 million USD in earnings last year”

A global macro strategy is a hedge fund or mutual fund strategy that bases its holdings — such as long and short positions in various equity, fixed income, currency, commodities, and futures markets. So the fund managers bet according to overall economic and political views of various countries or their macroeconomic principles.

Ken Griffins, Citadel held the third place with 870 million USD in earnings last year.

That is about 800 million USD less than James Simons Renaissance alpha returns, nevertheless, an impressive performance bearing in mind that if most pensions were invested in index fund they would have lost money that year.

Ken Griffins, Citadel is described as a multi-strategy fund using both quant and macro investing strategies.

John Overdeck’s Two Sigma and David Siegel came in next with both respectively bagging 770 million USD each in earnings during 2018.

James Simons Renaissance alpha returns during a dismal year proves that investment funds can and indeed do vary greatly in their performance

What’s more with 2019 likely to be another tumultuous year as the hard data and corporate earning already tanking in the first quarter pension fund manager could start turning to titan hedge funds as a solution to the pension crisis.

Could James Simons Renaissance alpha returns and other titan hedge funds alike mean that the crème de la crème of the markets gambling world solve the pension crisis?