James Simons Renaissance strategy change which entails relying less on quants and more on macro investing strategies could suggest unprecedented volatility ahead.

Global macro strategies build a portfolio around predictions and projections of large scale events on a continental and global scale.

“James Simons Renaissance strategy change which entails relying less on quants and more on macro investing strategies could suggest unprecedented volatility ahead”

James Simons Renaissance strategy change comes as no surprise, bearing in mind that we live in unprecedented times which is reflected in a volatile stock market

Last December was the worst for stocks since the Great Depression and January was the best for stocks in 30 years. Put simply, the bot traders (algos) can’t make heads or tails of the market.

With no dot plot Fed rate hikes and QE near exhaustion there is no clearly defined parameter which makes it possible for the bot and carbon traders to make profits.

But that was not the case last year, hence James Simons Renaissance alpha returns of 1.6 billion USD in 2018.

Now James Simons Renaissance strategy change is to cut back on using quantitative trading, a strategy which relies on number crunching and mathematical computations to identify trading opportunities

James Simons Renaissance alpha returns of 1.6 billion USD in 2018 underscores the fact that quantitative trading can be profitable when the parameters are easily identified.

“Last December was the worst for stocks since the Great Depression and January was the best for stocks in 30 years. Put simply, the bot traders (algos) can’t make heads or tails of the market”

Quant funds were pioneered by the billionaire John Henry and the founders of Man Group’s AHL fund. David Harding, Martin Lueck, and Michael Adam also use complex computer models created by teams of Ph.D. scientists to try to detect trends and other patterns in futures markets.

During the financial crisis of 2008 quantitative funds made double-digit gains by profiting hugely from falling equity and oil prices, while most other investors suffered large losses.

“many algo funds have otherwise delivered largely lackluster returns, sparking concerns over overcrowding in the sector”

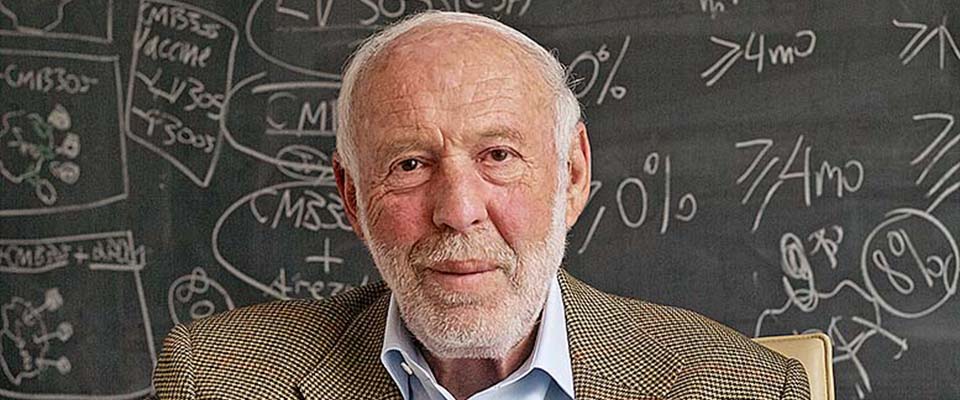

Renaissance, one of the world’s most respected hedge funds among its rivals, allows only company employees to invest in its oldest fund, Medallion. Its success has helped make James Simons one of the world’s richest men, with an estimated fortune of $21.5bn, according to Forbes.

But despite impressive returns in 2014, many algo funds have otherwise delivered largely lackluster returns, sparking concerns over overcrowding in the sector.

As a result of Renaissance’s decision, only a very small portion of RIDA’s assets are now invested in such futures strategies. Instead, Renaissance will trade more in Japanese and Hong Kong stocks.

So James Simons Renaissance strategy change to global macro trading suggests that the mechanical brain, Artificial intelligence still can’t handle wild cards. There is still demand for talented macro traders.