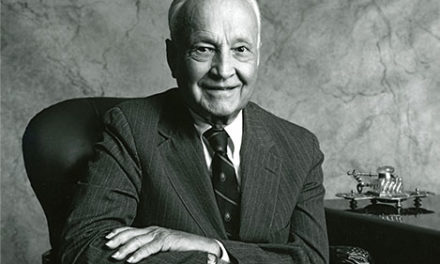

Jim Rogers is known for co-founding the Quantum Fund with George Soros which achieved Stella returns of 4200% over a decade, by contrast, the S&P advanced about 47% during the same time period.

He is also known for being the creator of the Rogers International Commodities Index (RICI). The RICI tracks 38 commodity futures contracts from 13 international exchanges. Moreover, because the index has had very few changes since 1996 it is considered by commodity investors as being a reliable gauge.

Jim Rogers is a bit of a maverick, independent-minded. He doesn’t consider himself a member of any school of economic thought and is critical of mainstream economics. Rogers is a well-respected voice in the alternative media.

He has acknowledged that his views are more in tuned with Austrian School of economics, which argues that valid conclusions cannot be made using solely statistical analysis, instead the Austrians look at actions and inactions of individuals and groups (collectives). It is a school of thought based on methodological individualism.

In 1964, Jim Rogers graduated with a bachelor’s degree in History from Yale University. He then worked on Wall Street, at Dominick & Dominick. In 1966, Rogers earned his second BA degree in Philosophy, Politics, and Economics from the University of Oxford. From 1966 to 1968, he served as a draftee in the US Army for military service during the Vietnam War.

In 1970, Jim Rogers joined investment bank Arnhold and S. Bleichroder, where he worked with George Soros. Three years later (1973) Soros and Rogers both left and founded the Quantum Fund.

In 1980, Jim Rogers decided to “retire” and spent some of his time traveling on a motorbike around the world. Since then, he has been a guest professor of finance at the Columbia Business School.

He also traveled through China, as well as around the world, on a motorbike, over 100,000 miles (160,000 km) across six continents, which was picked up in the Guinness Book of World Records.

January 1, 1999, and January 5, 2002, Jim Rogers did another Guinness World Record journey through 116 countries, covering 245,000 kilometers with his wife in a custom-made Mercedes.

Jim Rogers is a regular guest on Fox News’ and other financial TV shows.

In December 2007, Rogers sold his mansion in New York City for about 16 million USD and moved to Singapore.

Jim Rogers believes that now is a ground-breaking time for investment potential in Asian markets. Rogers’s daughters speak fluent Mandarin to prepare them for the future.

Jim Rogers is known for co-founding the Quantum Fund with George Soros which achieved Stella returns of 4200% over a decade, by contrast, the S&P advanced about 47% during the same time period.

INVESTMENT STYLE

Jim Rogers is investing in the so-called pivot to the East.

He is quoted as saying: “If you were smart in 1807 you moved to London, if you were smart in 1907 you moved to New York City, and if you are smart in 2007 you move to Asia.”

He is a value investor who focuses on top companies in agriculture, mining, metals, and energy sectors as well as those in the alternative energy space including solar, wind and hydro.

In September 2015, Jim Rogers left the Indian market saying it is impossible to invest on hope

LEARNING RESOURCES

Jim Rogers tells his adventures and worldwide investments in Investment Biker, a bestselling book.

In 2005, Jim Rogers wrote Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market. Rogers believes that commodities investment is one of the best investments over time.

If you were smart in 1807 you moved to London, if you were smart in 1907 you moved to New York City, and if you are smart in 2007 you move to Asia – Jim Rogers

CONNECT WITH INVESTOR

Follow this World Top Investor via their various social media channels and read more about their background and current investment interests on their official website:

Jim Rogers

www.jimrogers.com