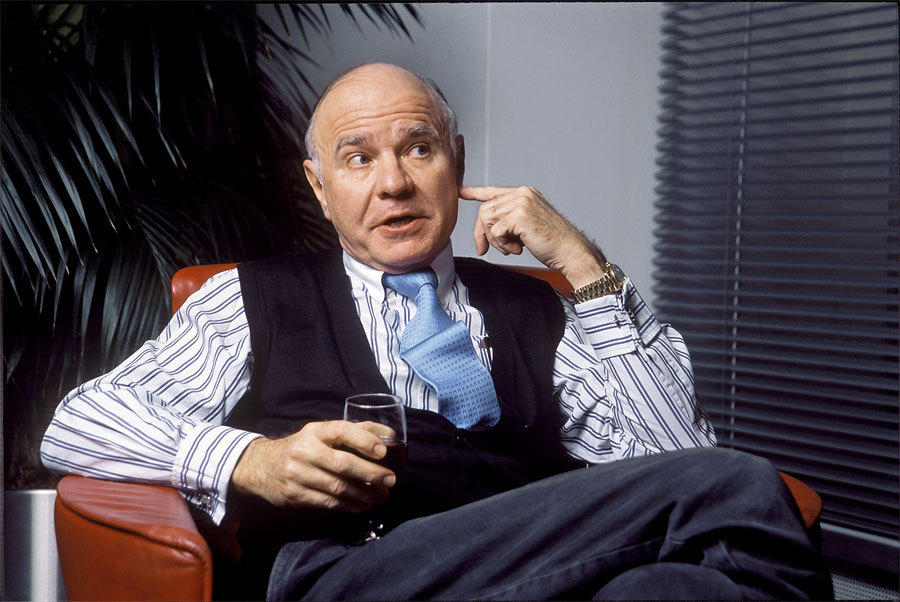

Marc Faber cites investment observations which he has noted over an investment career spanning almost four decades.

Mark Faber is the publisher of the Gloom Boom & Doom Report newsletter, he has been dubbed a permabear and a gold bug.

“Buy a $100 U.S. bond and frame it to teach your children about inflation by watching the U.S. bond value diminish to almost nothing over the next 20 years” said Mark Faber.

“Buy a $100 U.S. bond and frame it to teach your children about inflation by watching the U.S. bond value diminish to almost nothing over the next 20 years”

MARK FABER

No investment always works is number one on Marc Faber cites investment observations list

Mark Faber explains his reasoning; “If there was one single rule, which always worked, everybody would in time follow it and, therefore, everybody would be rich. But the only constant in history is the shape of the wealth pyramid, with few rich people at the top and many poor at the bottom” wrote Marc Faber.

Here comes the most honest advice we have ever heard from any top investor,

“Thus, even the best rules do change from time to time” he wrote.

The changing financial landscape, politics, and disruptive technologies mean that an investment strategy that worked in one decade and made a fortune could be disastrous in future decades.

“Thus, even the best rules do change from time to time”

MARK FABER

Will real estate be a winner in an environment of higher taxes, spiraling maintenance costs, and securing a mortgage is becoming increasingly difficult in the gig economy?

Moreover, as worker participation rates continue to decline as smart bots increasingly replace workers at an alarming rate, populations are likely to elect left learning governments.

In other words, the implication for landlords is that laws could favor tenants over landlords going forward

Private residency rental investment could become too risky as maintenance costs spiral.

“Far more countries’ stock markets went to zero than markets, which have survived” – Mark Faber

The introduction of Universal Basic Income could mean paying double rates for the skilled tradesman and higher property taxes to part-fund this new socialist utopia

Short-term renting of office accommodation was a booming business in the 90s but could the digitalization of the economy also mean less demand for commercial real estate going forward?

Stocks always go up in the long term is second on Marc Faber cites investment observations list

Look what disruptive technologies did to Kodak, Rank Xerox, and video blockbuster. Moreover, we believe that technology, particularly artificial intelligence, and quantum computing could shorten the long wave of innovation. In other words, the disruptors are disrupting themselves at a faster rate which means the investment timeline in a cutting-edge technology could have halved. The policy change, the decarbonization of the economy could mean that fossil fuel investment underperforms over the next decade.

“Far more countries’ stock markets went to zero than markets, which have survived. Just think of Russia in 1918, all the Eastern European stock markets after 1945, Shanghai after 1949, and Egypt in 1954” wrote Marc Faber.

Real Estate always goes up in the long term is also high up on Marc Faber cites investment observations list

“While it is true that real estate tends to appreciate in the long run, partly because of population growth, there is a problem with ownership and property rights. Real estate in London was a good investment over the last 1000 years, but not for America’s Red Indians, Mexico’s Aztecs, Peru’s Incas, and people living in countries, which became communists in the 20th century. All these people lost their real estate and usually also their lives” wrote Marc Faber.

The buy low and sell high rule also features on Marc Faber cites investment observations list

“The problem with this rule is that we never know exactly what is low and what is high. Frequently what is low will go even lower and what is high will continue to rise” he wrote.

Another dangerous rule which gives a false sense of security is to buy a basket of high-quality stocks and hold them, according to Marc Faber

“Today’s leaders may not be tomorrow’s leaders. Don’t forget that Xerox, Polaroid, Memorex, Digital Equipment, Burroughs, Control Data were the leaders in 1973. Where are they today? Either out of business or their stocks far lower, than in 1973!” wrote Marc Faber.

Indeed, technology killing off corporate America: Average life span of companies under 20 years

Blockchain, an encrypted digital ledger, technology that has existed since the 90s is disruptive today but could quantum computing, the ability to solve computational problems disrupt today’s blockchain technology.

“Everybody is out to sell you something” – Mark Faber

Google AI in partnership with NASA is currently working on quantum computation, which could be used to solve the highest level of encryption, in other words, hack the blockchain

Think of what impact quantum computing could have on Bitcoin, which is considered a store of value today if the Bitcoin blockchain could be hacked.

Don’t trust anyone is also on Marc Faber cites investment observations list

“Everybody is out to sell you something. Corporate executives either lie knowingly or because they don’t know the true state of their business and the entire investment community makes money on you buying or selling something” wrote Marc Faber.

Marc Faber recommends investing where you have an edge!

“If you live in a small town, you may know the local real estate market, but little about Cisco, Yahoo, and Oracle. Stick with your investments in assets about which you may have a knowledge edge” wrote Marc Faber.

Marc Faber also notes that best investments are frequently the ones you did not make.

“To make a really good investment, which will in time appreciate by 100 times or more, is like finding a needle in a haystack. Most “hot tips” and “must buy” or “great opportunities” turn out to be disasters” he wrote.

Finally, Marc Faber recommends investing in yourself, which was also an investment tip from Warren Buffett.

“Today’s society is obsessed with money. But the best investments for you may be in your education, in the quality of the time you spend with the ones you love, on your own job, and on books, which will open new ideas to you and let you see things from many different perspectives” he wrote.