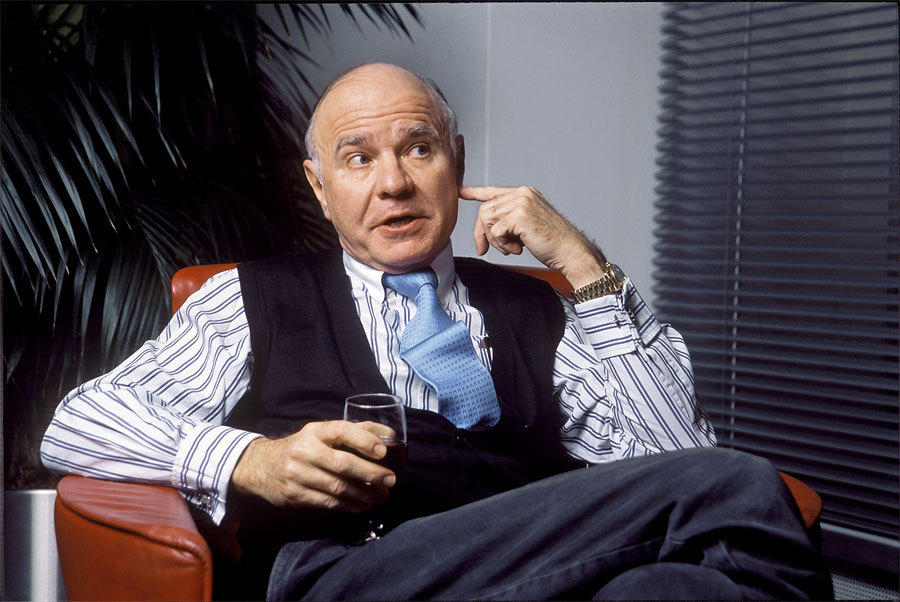

Marc Faber gives his insight into the Federal Reserve’s likely direction in his latest interview.

Marc Faber is a Swiss investor and publisher of the Gloom Boom & Doom Report newsletter.

The Fed is now faced with two options either continuing to hike interest rates to fight inflation and sell bonds, quantitative tightening, known as contractionary monetary policy.

But with the economy already in a recession, the Fed risks triggering the great depression 2.0 with more than 30% unemployment.

The alternative, the Fed can pivot to monetary easing, which entails quantitative easing, QE to infinity with zero or near percentage interest rate.

But that would allow inflation to run hot with 20% plus stagflation, which could also destroy the reserve status of the US dollar.

“with the economy already in a recession, the Fed risks triggering the great depression 2.0 with more than 30% unemployment”

WEALTH TRAINING COMPANY

Marc Faber gives his insight believing that the monetary authorities should take a non-interventionist approach

“Whatever government does, they should leave matters to free markets,” said Marc Faber.

But Marc Faber doesn’t believe the Fed will take a non interventionist approach and continue to reflate, extend and pretend.

Marc Faber gives his insight going back over a century

“Over the last 100 years, we had the shrinkage of the private sector and expansion of the government sector,” he said.

Marc Faber noted that the expansion of the government sector has become more interventionist and that the economic growth slowed down.

“So if you look at Britain between 1800 and 1900 or the US, it was much stronger in the last century. Economic growth, in terms of personal gain, has slowed down, and over the last 40 years, I would say for most people, there has been no progress,” said Marc Faber.

“Over the last 100 years, we had the shrinkage of the private sector and expansion of the government sector”

MARC FABER

Marc Faber gives his insight believing that most government officials are self-interested

Public officials often pursue their interest, which is often not for the benefit of society.

“Best option would be to close down the Fed and abandon the Fed,” he said.

“That all these people we had at the Fed are money printers and nothing else interventionist with a lack of knowledge of history and social sciences,” he said.

Milton Friedman’s theories are how Marc Faber gives his insight into Fed policy

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption. Friedman was best known for explaining the role of money supply in economic and inflation fluctuations. By managing the amount of money sloshing through a financial system, Friedman theorized, central banks could control inflation without making costly mistakes.

“The last three Fed Chair people all subscribe to Milton Friedman theories,” said Marc Faber.

“Tighten at the wrong Time makes matters much worse” – Marc Faber

Marc Faber gives his insight and notes that the Fed officials took Milton Friedman’s theories out of context

Milton Friedman always advocated for small government non-intervention and argued that a computer would do a better job than Fed officials that print at the wrong time.

“Tighten at the wrong Time makes matters much worse,” said Marc Faber.

Marc Faber believes the worst possible option for the US would be to print money.

The Swiss investor believes the recession would have occurred in 2019 or 2020.

“They flushed the system with cash, and the huge liquidity bubble prolonged the artificial expansion of the US,” he said. “But that also led to higher debts and inflation rates,” he said.

“Milton Friedman was clear about the view that financing public spending with money creation was inflationary,” he said.

Marc Faber gives his insight concerning inflation

“The transitory inflation narrative was a blatant lie, they are liars intellectually completely dishonest characters, including madame Lagarde,” said Marc Faber.

“What they are telling the public is completely wrong,” he added.

Marc Faber gives his insight into how academics, portfolio managers, and the government are all in the Fed’s pocket

“In the economic sphere, academics frequently are consulted by the Fed,” he said. Academics are paid handsome research fees, so they will never say anything against the Fed, according to Marc Faber. “The portfolio managers have always applauded the money printers and bailouts because the fees of money managers depend on rising stocks,” he said.

“So the higher stock markets go, the larger his fees are,” added Marc Faber.

“Fund management and academics have been bribed by the Fed. The Fed is the government, they finance the government, it is branch number four of the government they always applauded money printing” – Marc Faber

The crux to Marc Faber giving his insight view on the Fed is that nobody, no entity with influence will go against the Fed

“Fund management and academics have been bribed by the Fed. The Fed is the government, they finance the government, it is branch number four of the government they always applauded money printing,” said Marc Faber.

In other words, the Fed has got everyone in its pocket, the government, policymakers, academics, and the wealthy class.

Moreover, CBDC will be like the digital tag on prisoners on parole. Citizens rights once taken for granted in liberal democracies, free movement, and speech access to necessities will have to be earned based on one’s obedience to the system, determined by a social credit system. Frankly, we see a dystopian future, where tyrannical governments will sculpt society in their vision of utopia. The Bilderberg group is playing Minecraft for real, and there will be no resistance.

Marc Faber gives his insight into the Fed policy that the most influential western institution will continue doing what it has been doing printing money

Every economic crisis has been met with the same solution, which is print more money. .

The outcome has also become clear: the wealthy class has become wealthier with more overreaching governments.

The richest 1% gained $6.5 trillion in wealth last year.

So, the wealthy class is consolidating wealth, and the government is consolidating power, and if you think that is coincidental, I have got a bridge to sell you.