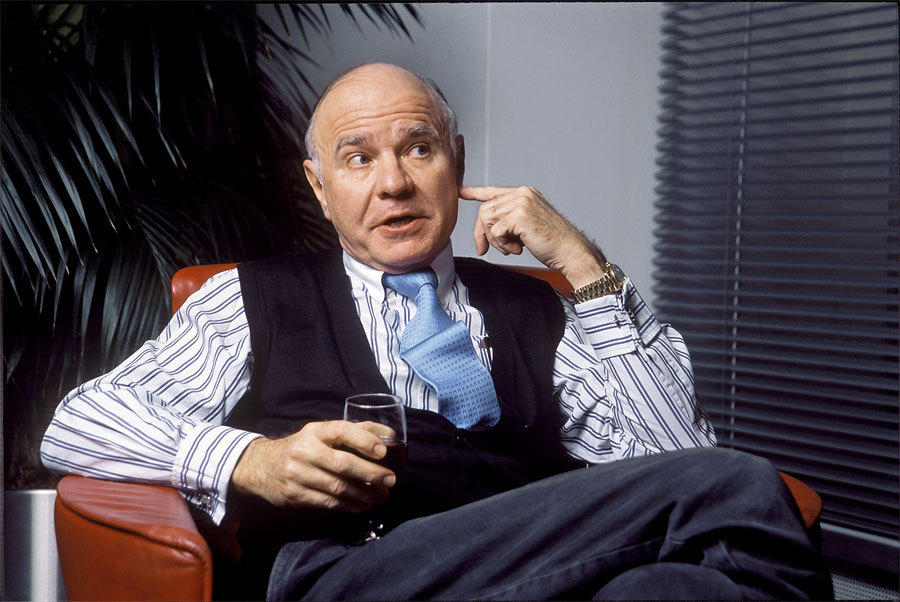

Marc Faber highlights topics ranging from the risk of state capitalism to the impact of lockdowns, and how to invest in these dangerous geopolitical times.

Private sector investments are more efficient than public investments, according to Marc Fabers’ highlights.

“Someone who owns a business is careful of what he does because his business is on the line. Government officials are not punished for wrong decisions, they can go to war in Afghanistan,” he said.

“People and government officials make money from wars,” added Marc Faber.

“omeone who owns a business is careful of what he does because his business is on the line. Government officials are not punished for wrong decisions, they can go to war in Afghanistan”

MARC FABER

Marc Faber highlights the injustice of national treasure and blood spent by the many for the few who gain

“But war is a lot of misery and suffering for civilians and soldiers. Government officials never get punished for these crimes,” he said.

Marc Faber points out that profit motive determines business investment, and when a bad investment is made the business goes bankrupt.

By contrast, when government policies fail to yield results, they double down.

So, when states go to war and lose, it sheds more blood and treasure.

But the spoils of war for those who prosecute it are about expanding an Empire, occupying lands, suppressing and repressing, and imposing one system with that of the victors.

The hegemon’s crown jewel, its Reserve currency, is gained through economic, and military conquest.

Little has changed since the naked ape crawled out of his cage wielding a club.

The only thing that has advanced is the sophistication of his weapons. The naked truth, the tribe which dominates has the best spears.

History, laws, and rules are all written accordingly. If the naked ape had truly advanced, we would not see war today in the heart, the breadbasket of Europe.

“But war is a lot of misery and suffering for civilians and soldiers. Government officials never get punished for these crimes”

MARC FABER

Cavemen with nukes

The current war is likely to lead to another peek into hell. We are witnessing a global power struggle, for survival amongst the elites of two great powers. The veneer of a proxy war is fading and is likely to end with two great superpowers sitting at the table, both with their nuclear barrels drawn, cocked, and aimed at the heart of each other.

The doctrine of MAD, mutually assured destruction, an east-west-centric world with its security trade alliance is likely to emerge.

Marc Faber highlights his discontent with the current US administration

“The Biden Administration looks like it intends to destroy the United States,” he said. He doesn’t think they have the interest of the United States as a country. “They want social justice for the whole world, letting everyone settle in the US. Letting the American spirit become like Venezuela,” he said.

The risk of another civil war in the US is growing according to political scientists and prominent investor Ray Dalio.

“I have to say US assets and the market have become rather vulnerable” – Marc Faber

Marc Faber highlights what attracts capital inflow

Capital moves to countries that are stable and growing.

Under the current administration, the USD has become very vulnerable. Indeed, the strength of the dollar due to the lack of confidence in the economy, and geopolitical instability has the potential to trigger an emerging dollar-denominated loan default crisis.

“I believe that people will start to question the value of US assets which appears to be an environment, which is anti-capitalistic,” he said.

“A growth company depends on an Administration favorable to it becoming successful and not on an administration legalist system that retards its growth,” he added.

“For that reason, I have to say US assets and the market have become rather vulnerable,” said Marc Faber.

Marc Faber highlights the current shortages, supply disruptions

We should ask why we have some supply constraints. Why are energy prices going up so much? The world decided to use clean energy.

Does it use more energy or less energy?

Most of the problems we see today in the supply chain and energy and other commodities are government-induced,” he said. Indeed, I wrote a recent piece on policy-induced shortages, which supports the golden billion thesis.

“The US had lockdowns and closed the schools, the kindergartens, and daycare centers.

When the daycare center closes, one parent has to stay at home, and 30% of businesses close, which diminishes the supply chains,” he said.

“Under the capitalist system, the world becomes richer everywhere. In the former Soviet Union, nobody wants to get close to socialism anymore”

– Marc Faber

Marc Faber highlights how to invest in these precarious times

“I think people should have cash. I know that it is unpopular, but I have 20% of my assets in cash. I believe no matter how you slice it, valuations are high.

“I believe when you invest in pharmaceutical companies or utilities, the government influence is huge,” he said.

Marc Faber highlights the government is involved in micro and macro-management.

The more the government is involved, the greater the corruption.

Investing has become politicized, making the investment landscape changeable according to the government of the day.

Shareholders could lose everything investing in a utility if the government of the day shifts to nationalization.

“I would own some precious metals,” he said.

The most important thing for the capitalist system is that people respect the law.

The basis of the capitalist system is a legal system

And if it is popular capitalism it is about innovation, creating products, services building wealth, not about destruction or war.

“Under the capitalist system, the world becomes richer everywhere.

In the former Soviet Union, nobody wants to get close to socialism anymore,” he said.

China has become more capitalist than the European Union.