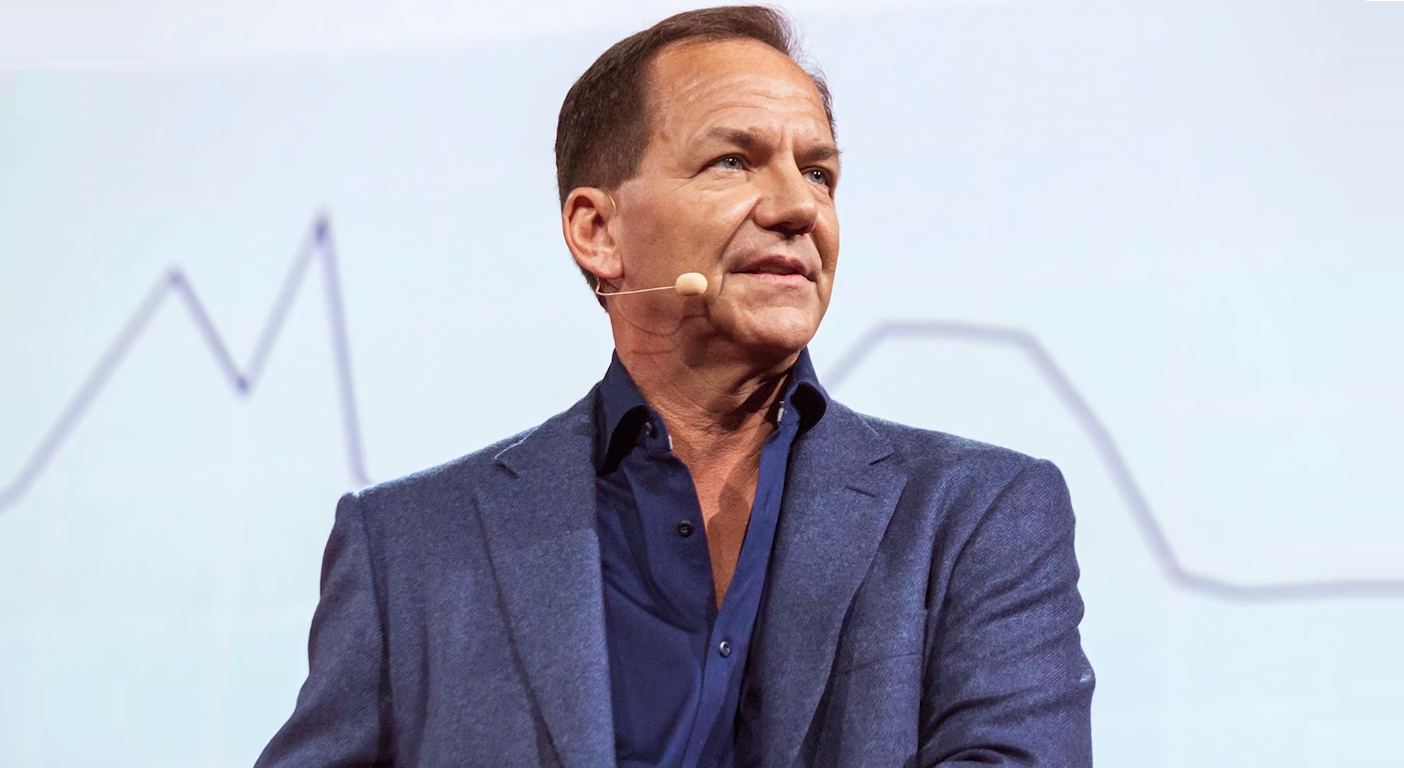

Paul Tudor Jones gives his thoughts on a range of investing hot button topics from geopolitics, ESG, and recession investing in his recent interviews in late 2022 and January this year.

Billionaire hedge fund manager Paul Tudor Jones has warned that the US economy is heading for a recession. But he believes the market could rally depending on how Russia’s war in Ukraine plays out.

“Billionaire hedge fund manager Paul Tudor Jones has warned that the US economy is heading for a recession. But he believes the market could rally depending on how Russia’s war in Ukraine plays out”

WEALTH TRAINING COMPANY

Paul Tudor Jones gives his thoughts on geopolitics, particularly how the Ukraine war plays out, and it raises eyebrows

“We have a dictator who’s losing, and typically that doesn’t end well,” Jones said on Oct. 10 on CNBC’s “Squawk Box.”

“Typically, that’s going to end with a violent death and the question is who is he going to take with that?”

So Paul Tudor Jones believes that the war in Ukraine will end with the death of Putin. He said what Putin chooses to do before the war comes to a close could have significant consequences on broader markets.

Paul Tudor Jones gives his thoughts on the Ukrainian war by outlining various scenarios

He considers the war widening.

“Is it gonna be the regional focus between Russia and Ukraine or does it expand beyond that?” he asks.

In September 2022, Russian President Putin warned that he isn’t bluffing when it comes to using nuclear weapons to defend Russia.

“We have a dictator who’s losing, and typically that doesn’t end well”

Paul Tudor Jones

“When the territorial integrity of our country is threatened, to protect Russia and our people, we will certainly use all the means at our disposal,” Putin said before accusing the West of engaging in “nuclear blackmail.”

In January, Russian media host Vladimir Solovyov urged Russians not to fear death, claiming life is “highly overrated.”

Paul Tudor Jones gives his thoughts on the growing threat of nuclear war, which keeps markets on a predictable edge

“The potential for nuclear war is an ongoing threat to the markets, Jones said.

“The two outcomes have such two dramatically different impacts on the markets. If all of a sudden he (Putin) was gone tomorrow … you’d have this massive rally in risk, and yet if — what I think is probably more probable — he escalates the kinetic side of his response, then you have just the opposite, the Armageddon scenario,” Jones said.

“If you take just 100, these are the top hundred firms, they have outperformed the Russell 2000 Index since its inception” – Paul Tudor Jones

Paul Tudor Jones believes that nobody can predict the outcome, but he suggested that he has a hedge in place

“If you’ve got something that’s going to be exposed to, again, an escalation in the kinetic response, whether it’s chemical weapons or a tactical nuke or whatever, we make everyone cover their tails because, again, the outcomes are so binary and they have such massively different consequences for so many different asset classes,” Jones said.

Frankly, a wide scale nuclear conflict would be unprecedented, and preparing and prevailing in this apocalypse scenario would be futile.

In the worst-case scenario, there will be no 2024, and you might as well make peace with whoever God you pray to, say goodbye to your near and dear, bend down in a fetal position, and kiss your assets goodbye.

Moving onto a lighter note Paul Tudor Jones gives his thoughts on the just 100 and ESG investing

Paul Tudor Jones believes that a company’s stock will outperform if it does what Americans want.

“If you take just 100, these are the top hundred firms, they have outperformed the Russell 2000 Index since its inception,” said Paul Tudor Jones.

“Last year the just 100 outperformed the Russell by 3% and outperformed the NASDAQ by 20%,” he added.

It is really clear if you do what the vast majority of Americans want, your company will be rewarded in its stock performance, and on average is going to excel on a whole variety of measures such as return on equity, and profit margins such as paying dividends.

The just 100 paid five times the amount of dividends that the rest of the Russell paid,” he said.

“Whoever is president in 24, will be dealing with debt dynamics, which are so dire that we will have fiscal retrenchment” – Pauk Tudor Jones

Paul Tudor Jones believes ESG investors underperform because they are not looking at the data like the just 100 or 1000 companies, which he ranks

Just 100 investors believe it is okay to be cynical about a company whose primary function is to do good at the cost of shareholder value.

Just 100 investors believe a company’s primary goal is to return shareholder value and not waste shareholder value.

So just 100 investing is a backlash to ESG investing.

Paul Tudor Jones gives his thoughts and reflections on the previous decades

“If you think about every decade, then the 70s was the decade of inflation; the 80s a boom-bust with swings in dollar volatility; the 90s dot-com bubble, the 2000s was the debt finalization mortgage crisis. The teens were the peak of globalization and probably the peak of central bank experimentation of monetary policy. The 20s is going to be a period when we focus on debt dynamics, country by country fiscal deficits and the need to run fiscal policy, which gives people confidence in the long-run value of the currency,” he said.

Paul Tudor Jones gives his thoughts on recession investing and the 24 presidential elections

“Whoever is president in 24, will be dealing with debt dynamics, which are so dire that we will have fiscal retrenchment.

Something like Bitcoin, Ethereum which has a finite supply will have value if we are going through a recession playbook. The first thing to happen, short rates will stop going up when we get into that recession, there will be a point when the Fed stops hiking, and it will start to slow down or at some point, even reverse those cuts. When that happens, you will have a massive rally in various beaten-down inflation trades, including crypto.”

In short, choose your favorite scarce asset.