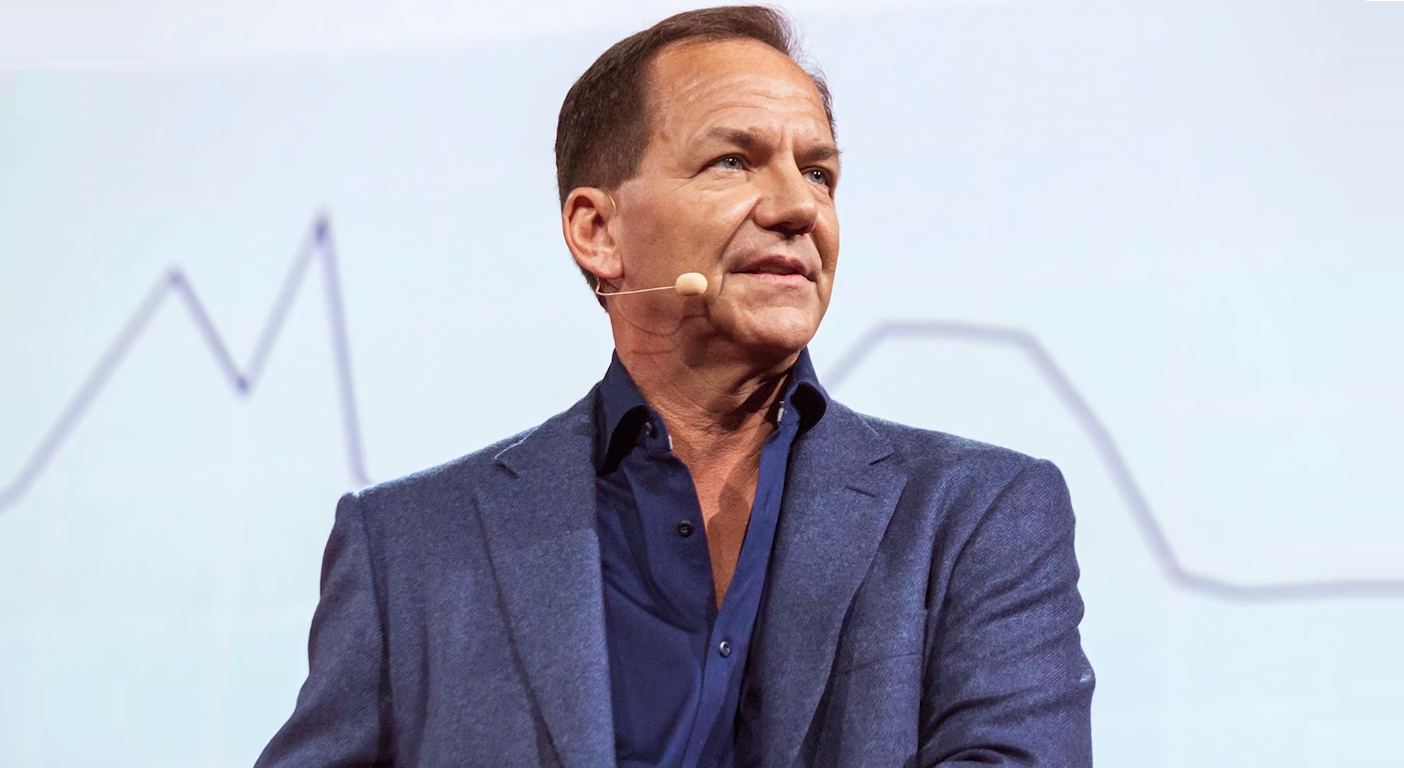

Paul Tudor Jones goes bargain hunting for undervalued stocks, which is a sea change from last month when the billionaire maverick trader took to the stage saying sell everything bonds and stocks.

The sell in May and go away turned out to be another Paul Tudor Jones bang on the money call as everything sold off into bear or near bear territory.

But for traders, short term investors a month is a long time and now Paul Tudor Jones is buying undervalued stocks.

“Paul Tudor Jones goes bargain hunting for undervalued stocks, which is a sea change from last month when the billionaire maverick trader took to the stage saying sell everything bonds and stocks”

PAUL TUDOR JONES

Indeed, Paul Tudor Jones is bargain hunting for stocks that got gutted in May’s bloodbath sell off

The investor theme not long ago was how do I not lose money in these tumultuous markets.

But could that theme change as the likes of Paul Tudor Jones is bargain hunting for stocks, bearing in mind the king of traders is one of the best market timers of our era.

Betting on an upturn from here is betting on whether inflation has peaked and how much pain the Fed intends to inflict on investor portfolios. A neutral or more Dovish Fed will give the bulls footing to win back lost territory. The Fed’s rationale for tightening, which is wreaking havoc on portfolios, is to fight inflation. But as we have noted inflationary pressures is primarily due to geopolitics supply side disruptions causing energy and food commodities to skyrocket. Moreover, Fed chair Powell has admitted monetary policy tools cannot resolve supply side shocks from the war in Europe and the pandemic. In fact, we would argue that further tightening could trigger a wave of bankruptcies and disrupt further supply chains, thereby adding to inflation.

“The investor theme not long ago was how do I not lose money in these tumultuous markets”

WEALTH TRAINING COMPANY

We are in an extremely complex and delicate situation with the US public deficit now over 30 trillion USD. a 10 year treasury note cannot continue to yield negative returns as investors will dump the asset, sending yields higher and making it more burdensome for the US government to service debt. Perhaps one saving grace is the strength of the USD dollar. So holding US paper with some yield s is better than owning a foreign asset in a local currency losing 10 to 20% versus the USD. But it is the historic US deficit which could force the Fed to surrender to inflation, or just hope that the inflation fire burns out. The fourth largest budget item is interest on the debt now stands at $435 billion dollars. Moreover, with the US debt to GDP ratio at 129.18%, according to the US debt clock , the US government can not afford higher interest rates.

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem,” J. Paul Getty.

“Paul Tudor Jones’ hedge fund boosted its stake in Turquoise Hill Resources Ltd by 9% in Q1 2022, holding 690,472 shares worth $20.7 million”

– Wealth Training Company

Paul Tudor Jones goes bargain hunting could be another bang on the money if you believe the Fed is about to transition from tightening to neutral, or easing to keep their prized customer solvent

Turquoise Hill Resources Ltd. (NYSE:TRQ) is a subsidiary of Rio Tinto Group, operating as a mining company. primarily explores for copper, gold, and silver deposits. Paul Tudor Jones’ hedge fund boosted its stake in the company by 9% in Q1 2022, holding 690,472 shares worth $20.7 million.

Paul Tudor Jones goes bargain hunting for a health care stock, HCA Healthcare Inc (NYSE:HCA) which operates general and acute care hospitals in the United States.

HCA Healthcare provides medical and surgical, emergency, and outpatient services. Tudor Investment Corp boosted its a HCA Healthcare, Inc holding.

Paul Tudor Jones initially invested in the stock in 2011 and has held the position consistently over the years, apart from a few breaks.

HCA Healthcare announced earnings for the March quarter on April 22, reporting an EPS of $4.12, below consensus estimates by $0.12. Revenue for the period grew 6.93% year-over-year to $14.95 billion, beating Street forecasts by $225.27 million.

Stanley Black & Decker, Inc, tool maker is another stock Paul Tudor Jones goes bargain hunting.

Stanley Black & Decker, Inc. (NYSE:SWK) is an American company that engages in the tools, storage, and industrial businesses. Paul Tudor Jones’ Tudor Investment Corp increased its stake in Stanley Black & Decker, Inc. (NYSE:SWK) by 552% in Q1 2022, holding 76,692 shares worth $10.7 million. With a price to earnings ratio of 14.43, it is one of the undervalued names in the Tudor Investment Corp portfolio.

“the eyebrow raising stock which Paul Tudor Jones goes bargain hunting for is CBRE Group, Inc. (NYSE:CBRE), a Texas-based commercial real estate services and investment company” – Wealth Training Company

Paul Tudor Jones goes bargain hunting for financial stock Morgan Stanley (NYSE:MS)

Morgan Stanley is an American financial services holding company operating through Institutional Securities, Wealth Management, and Investment Management segments. The company serves individual, corporate, and government customers in the Americas, Europe, the Middle East, Africa, and Asia. 13F disclosures for the first quarter of 2022 reveal that Paul Tudor Jones’ fund owned 106,985 shares of Morgan Stanley (NYSE:MS), worth $9.35 million.

But perhaps the eyebrow raising stock which Paul Tudor Jones goes bargain hunting for is CBRE Group, Inc. (NYSE:CBRE), a Texas-based commercial real estate services and investment company. CBRE Group operates through three segments ,Advisory Services, Global Workplace Solutions, and Real Estate Investments. Paul Tudor Jones reported owning 109,564 shares of CBRE Group, Inc. (NYSE:CBRE) in Q1 2022, worth $10 million. The billionaire elevated his position in the company by 26% in the March quarter.

Paul Tudor Jones also likes Fortune Brands Home & Security, Inc. The company offers home repair, remodeling, new construction, and security applications for residential customers

Paul Tudor Jones boosted his stake in Fortune Brands Home & Security, Inc. (NYSE:FBHS) by 21%, holding 136,022 shares worth $10.1 million.

Other of Paul Tudor Jones goes bargain hunting favorites include;

TEGNA Inc. (NYSE:TGNA) is one of the undervalued stocks in Paul Tudor Jones’ Q1 portfolio, with his hedge fund increasing its hold on the company by 47%.

American broadcast, television, digital media, and marketing services company.

Finaly, Old Republic International Corporation (NYSE:ORI) which provides insurance underwriting and related services and Riley Financial, Inc. (NASDAQ:RILY) a California-based investment banking and financial services company stocks have also been bought by PTJ.