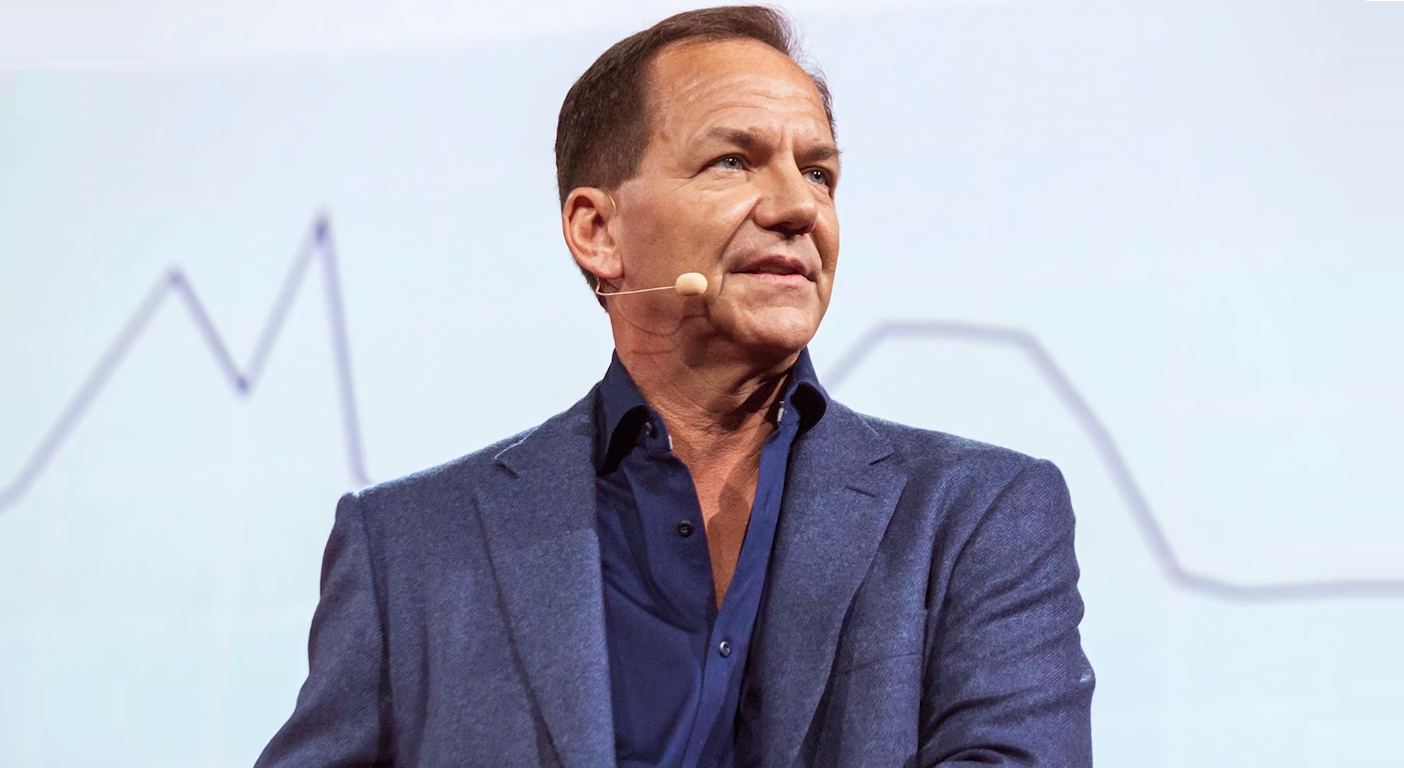

Paul Tudor Jones list of investing rules to follow are ten in total, according to the billionaire investor.

Cut losers short & let winners run is number one on Paul Tudor Jones list of investing rules

A big ego and overconfidence are an investor liability. It takes tremendous humility to navigate markets successfully. Going all in because you are so sure that an investment is likely to go your way eventually leads to huge losses. Always keep in your mind what if I am wrong this time, how much can I afford to lose without causing a massive change to your financial security. To survive markets, one must avoid overconfidence.

“Cut losers short & let winners run is number one on Paul Tudor Jones list of investing rules”

PAUL TUDOR JONES

Second, on Paul Tudor Jones list of investing rules is that investing without a specific end goal is a big mistake

Before investing, you should already know the answer to the following two questions, according to Paul Tudor Jones. At what price will I sell or take profits if I am correct? Where will I sell it if I am wrong?

Hope and greed are not investment processes, according to Paul Tudor Jones.

Third on Paul Tudor Jones list of investing rules is that emotional & cognitive biases are not part of the process

Avoid making an investment decision based on your feelings and hope, according to Paul Tudor Jones.

Fourth on Paul Tudor Jones list of investing rules is to follow the trend

“80% of portfolio performance is determined by the underlying trend,” said Paul Tudor Jones.

Rule 5 is to avoid turning a profit into a loss

Investing is about creating returns over time. If you don’t harvest gains, and then allow them to turn into a loss, you have started a “financial rinse cycle.” Moreover, “getting back to even” is not an investment strategy.

“Avoid making an investment decision based on your feelings and hope”

PAUL TUDOR JONES

The sixth rule on Paul Tudor Jones list of investing rules is that your odds of success improve greatly when technical analysis supports fundamental analysis

The market for a long-time can ignore fundamentals. As John Maynard Keynes once said: “The stock market can remain irrational longer than you can remain solvent”.

“only losers add to losers” – Paul Tudor Jones

The seventh rule; try to avoid adding to losing positions Paul Tudor Jones once said, “only losers add to losers”

The dilemma with “averaging down” reduces the return on invested capital, trying to recover a loss than redeploying capital to more profitable investments. Cutting losers short allows for more significant growth over time.

Rule number 8 is that in bull markets you should be “long.” and in bear markets – “neutral” or “short”.

The ninth rule on Paul Tudor Jones list of investing rules is to invest first with risk in mind, not returns

Finally, the tenth rule is that a portfolio manager should aim for a 70% correct rate

So, Paul Tudor Jones list of investing rules aims to minimize the psychological investment mistakes.