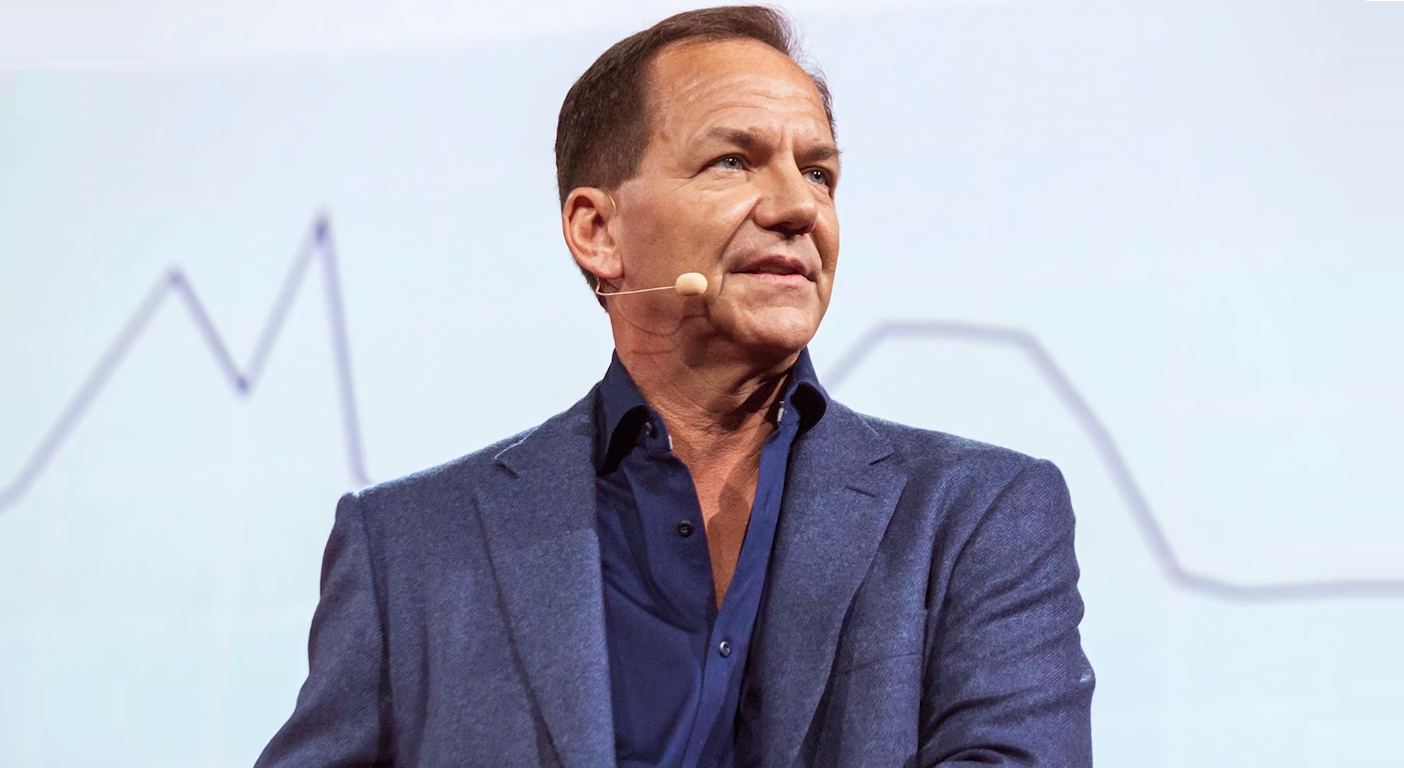

Paul Tudor Jones recent stock picks are raising eyebrows.

Paul Tudor Jones is a billionaire macro investor with a net worth of $5.8B, in 2021. He is the founder of the Tudor Investment Corporation an asset management firm headquartered in Greenwich, Connecticut with $38.4B assets under management. In short Paul Tudor Jones is a big fish in a big pond, he is considered to be amongst the world’s top macro traders.

“Paul Tudor Jones is a big fish in a big pond, he is considered to be amongst the world’s top macro traders”

WEALTH TRAINING COMPANY

Paul Tudor Jones recent stock picks include Biotechnology & Drugs company Immunomedics, Inc. (NASDAQ: IMMU)

Paul Tudor Jones added 2% of his fund to Immunomedics during the third quarter of 2020. The position was worth $45.105 million by the end of the quarter, making it the fourth-largest holding in his 13F at that time. Immunomedics is a clinical-stage biopharmaceutical company. The Company is engaged in developing monoclonal antibody-based products for the targeted treatment of cancer. Its technologies allow it to create humanized antibodies that can be used either alone in unlabeled or naked form or conjugated with radioactive isotopes, chemotherapeutics, cytokines, or toxins.

On September 13, 2020, Gilead Sciences Inc (NASDAQ: GILD) announced that it will acquire Immunomedics for $21 billion in cash and declared that it entered into strategic collaborations to foray into the lucrative oncology space.

Aimmune Therapeutics, Inc. (NASDAQ: AIMT) represents the fifth largest holding of Tudor Investment Corporation fund and is another one of Paul Tudor Jones recent stock picks

Aimmune Therapeutics is a biopharmaceutical company developing and bringing new treatments to people with potentially life-threatening food allergies. Paul Tudor Jones recent position was valued at $34.088 million and represented 1.5% of his overall fund holdings.

“Paul Tudor Jones added 2% of his fund to Immunomedics during the third quarter of 2020”

WEALTH TRAINING COMPANY

On August 31, 2020, Aimmune Therapeutics, Inc. entered into an acquisition agreement where predator Nestlé Health Science (NHSc) would acquire its target, Aimmune for $2 billion.

The acquisition price was $34.50 per share. Shares were trading near $12.60 on August 28, 2020, before soaring to $34.17 following the announcement.

Another one of Paul Tudor Jones recent stock picks includes Grubhub Inc. (NYSE: GRUB), a leading online and mobile food-ordering and delivery marketplace with the largest and most comprehensive network of restaurant partners

Paul Tudor Jones boosted his holding in Grubhub by 4,513%, which is valued at $18.368 million. The online and mobile food-ordering stock accounted for nearly 2.1% of his total portfolio. GRUB’s share price increased by 33% over the last twelve months. As per the latest 13F reporting period.

Grubhub managed the shift from offline to online food ordering for thousands of restaurants. The company has been expanding its partner base and now has more than 300,000 restaurants on its platform. Last June, Just Eat Takeaway.com (JET) and Grubhub agreed on a deal in which JET would acquire 100% of Grubhub via an all-stock transaction valued nearly at $7.3 billion. This merger was expected to be finalized in the first half of 2021.

“Paul Tudor’s fund raised its stake in the company (Advanced Disposal) by 170% compared to the second quarter of 2020 and the position accounted for 5.1% of the overall portfolio making it the largest investment in the fund” – Wealth Training Company

GCI Liberty Inc. (NASDAQ: GLIBA) represented another one of Paul Tudor Jones recent stock picks, which was also the second-largest holdings of the fund

Paul Tudor Jones fund position in the stock is currently valued at $71.309 million. The billionaire’s stake in the company was increased by 335,000 shares during the third quarter, with a 3.16% weight in the portfolio.

GCI Liberty, Inc. provides various communication services in the U.S. by offering data, wireless, video, voice, and managed services to residential customers, businesses, governmental entities, and educational and medical institutions.

Paul Tudor Jones recent stock picks included Advanced Disposal Services, Inc. (NYSE: ADSW), which accounts for the biggest stock pick of Paul Tudor’s hedge fund

Paul Tudor’s fund raised its stake in the company by 170% compared to the second quarter of 2020 and the position accounted for 5.1% of the overall portfolio making it the largest investment in the fund.

Advanced Disposal offers waste disposal, collection, and recycling services for residential, commercial, industrial, and construction customers.

ADSW shares have depreciated by 8% since the beginning of 2020 until being fully acquired by Waste Management (NYSE: WM) on October 30.

Under the terms of the merger agreement, Advanced Disposal stockholders were entitled to receive $30.30 per share in cash.

“I have got a small single-digit investment in bitcoin I am not a flag-bearer” – Paul Tudor Jones

The bulk of Paul Tudor Jones recent stock picks falls within ESG investing, which a number of investors are now calling the new safe haven

Environmental, Social, and Corporate Governance refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business.

Outside the basket of Paul Tudor Jones recent stock picks included precious metals investing, particularly gold.

Back in June 2019, the macro trader said his best trade was going to be gold for the next 12-24 months.

“We have had 75 years of expanding globalization and trade and we built a machine around that is the way it is going to be and now all of a sudden we stopped and we are reversing that” said Paul Tudor Jones.

“So, when you do something like that a lot of time consequences are not seen. That would make one think that we go down to zero rates, and of course in that situation, gold is going to scream” he added. But it is not just precious metals, Paul Tudor Jones turns bullish on Bitcoin which he is calling the “best inflation trade” out there.

To date, Bitcoin, a vote of no confidence, is providing investors with the best return and whether that is the case going forward remains to be seen.

“I have got a small single-digit investment in bitcoin I am not a flag-bearer” said Paul Tudor Jones.