Paul Tudor Jones’s downgrading of corporate credit view will bring about “scary moments” which will most likely test corporate bond investor’s nervous going forward.

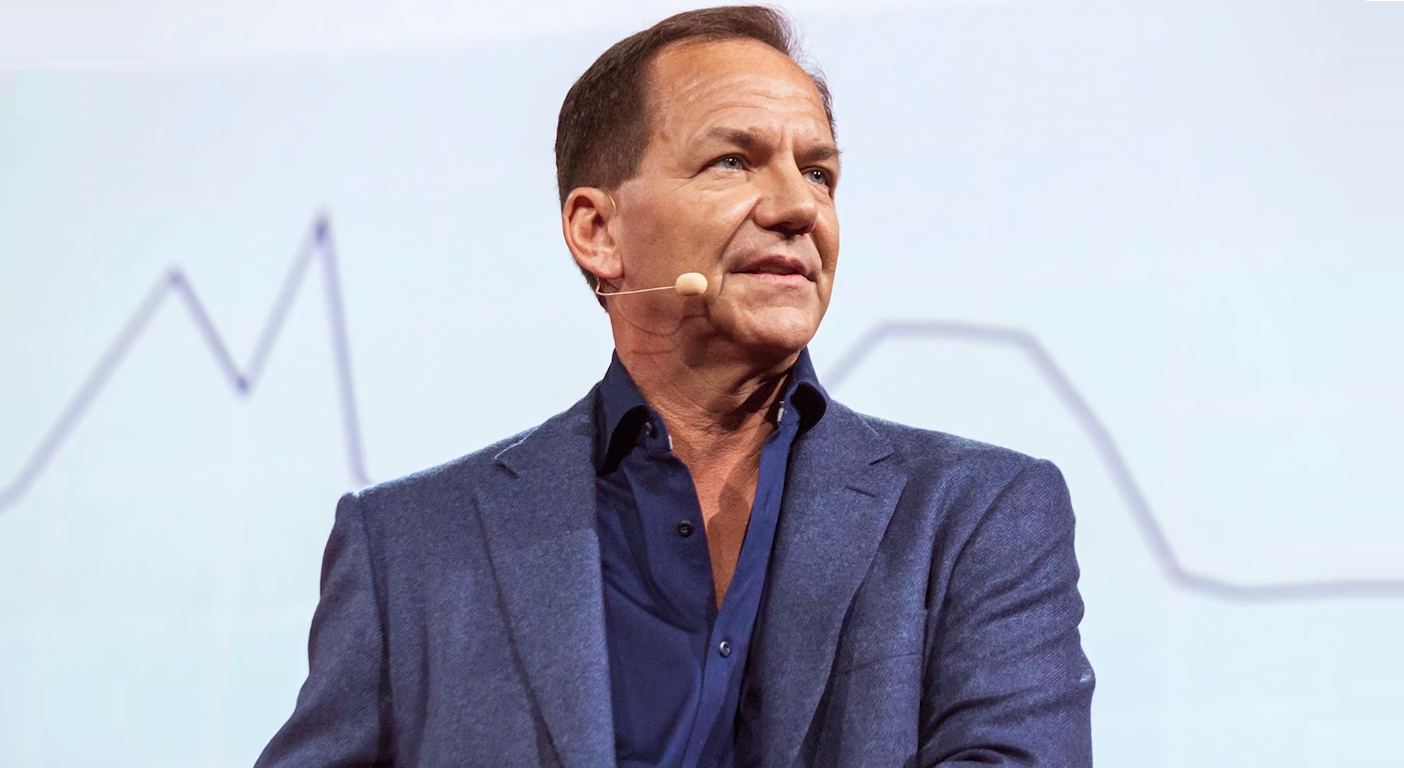

“We’re going to stress test our whole corporate credit market for the first time”, said Paul Tudor Jones hedge fund manager with a net worth of US $4.7 billion and the 120th richest person on the Forbes 400.

“We’re going to stress test our whole corporate credit market for the first time”

PAUL TUDOR JONES

Paul Tudor Jones’s downgrading of corporate credit view is likely to lead to turbulence for bond investors and it is what he refers to as “scary moments”.

“From a markets perspective, it’s going to be interesting. There probably will be some really scary moments in corporate credit” said Paul Tudor Jones.

But Paul Tudor Jones’s downgrading of corporate credit view is not a lonely voice in the wilderness.

Josh Lohmeier, head of U.S. investment-grade credit at Aviva Investors, which manages more than $480 billion also believes that corporate bond investors are in for some gut-wrenching volatility. “GE is a harbinger for what’s going to happen when large capital structures get downgraded,” and he added, “it’s going to be messy, and it’s going to be painful.”

So what spurred on Paul Tudor Jones’s downgrading of corporate credit view?

In a few words, the recent sell-off of GE, which was not so long ago America’s most valuable company. But there is more to GE’s sell-off than meets the eye, to put it simply the GE is battling not to end up junk bond status.

“From a markets perspective, it’s going to be interesting. There probably will be some really scary moments in corporate credit”

PAUL TUDOR JONES

A company’s stock price often collapses on news that its bonds have been downgraded to junk bond, or high yielding high-risk bonds. In the event of a corporate bankruptcy stock investors lose the entire value of their stock investment in the company.

“When the market begins to price you to junk status, you have a very limited time to clear that up before you become junk,” said Thomas Tzitzouris, director and head of fixed income research at Strategas. “Whether their plan is viable or not, they’re running out of time”.

GE’s stock market value has plunged to just below $70 billion, about $300 billion less than where it was in 2005, when it was last America’s most valuable company, according to S&P Dow Jones Indices.

So could this aging bull market be laid to rest with GE battling junk bond status?

Perhaps, the next crisis will begin with GE trading like junk.

“Corporate debt is the most dangerous part of the high-grade bond market” – Jeffrey Gundlach, CEO DoubleLine capital LP

Paul Tudor Jones’s downgrading of corporate credit view could gain momentum with contagion risks growing in the bond market

As Guggenheim’s Scott Minerd put it, “GE’s selloff is just the start of a “slide and collapse” in investment-grade credit”.

Moreover, Jeffrey Gundlach, CEO of DoubleLine Capital LP is also throwing his hat in the ring. “Corporate debt is the most dangerous part of the high-grade bond market”.

So Paul Tudor Jones’s downgrading of corporate credit suggests that another credit crisis could be brewing.

But unlike the 2008 financial crisis which was a credit crisis in high-risk household mortgages, a relatively small sector of the household mortgage market, this time it a crisis with high-grade corporate bonds. There are already concerns about GE contagion if GE ends up being downgraded to junk bond status that could disturb the credit market.

There is a lot of counterparty risk, how much of GE debt is own by investment banks, moreover, much of GE debt has been pledged as collateral for making new loans. When the investment banks realize that have grant loans on the back of worthless GE bonds the banks will demand more assets, collateral from their borrowers who may not have the liquidity. That could force borrowers to sell assets in a declining market. Also, keep in mind that the problem of GE contagion could also be magnified due to leveraging.

GE falling apart is like the default of a third world country.

“Since October 2017, when the Fed began its QE unwind, it has now shed $321 billion. But that is just scratching the surface, there is another $4 trillion or so to go!”

What is concerning about Paul Tudor Jones’s downgrading of corporate credit is that the billionaire hedge fund investor is waving the red flag during benign conditions, bearing in mind that the economy is supposedly buoyant and credit is cheap.

So what is going to happen when there is a real slow down and the Fed starts tightening in a more meaning full way.

At the last count the Fed’s balance sheet has now shrunk by $321 billion to $4.140 trillion, the lowest since February 12, 2014; since October 2017, when the Fed began its QE unwind, it has now shed $321 billion. But that is just scratching the surface, there is another $4 trillion or so to go!

In other words, yields could go a lot higher if the Fed becomes enthusiastic about quantitative tightening (QT), which is the inverse of quantitative easing. So if the Fed decides to QT in a big way, yields will spiral and that will make financing corporate debt even more burdensome.

Notice how QT is kept from ever reaching critical mass public awareness, it rarely or never gets a mention on the mainstream.

So here is the takeaway of Paul Tudor Jones’s downgrading of corporate credit view.

If the QT trade is Wall Street’s (low key) play of the day then the next trade will be a “front-end rates trade”. Put simply, guestimating when policymakers will cease interest rate hikes and trade accordingly.

But be warned not to jump the gun with the next “front-end rates trade”, the pain threshold is likely to be a lot higher this time before the Fed walks back “monetary normalization”.