Ray Dalio demystifies debt in his recent yahoo finance interview

“There two ways of dealing with debt: you pay it back in hard money or you pay it back in soft money, and If you pay it back in hard money, then you have a problem,” said Ray Dalio.

So the public deficits can either be paid through tax receipts or by running contractionary budgets, which is when the governments spend less than they receive in state tax revenue.

That is paying debt with hard money, according to Ray Dalio.

“There two ways of dealing with debt: you pay it back in hard money or you pay it back in soft money, and If you pay it back in hard money, then you have a problem”

RAY DALIO

Alternatively, the soft money approach to dealing with debt is to pay down the debt with more borrowing. So the US government issues treasury bonds, and the Federal Reserve creates dollars to purchase some or all of the newly issued treasuries.

Ray Dalio notes that the problem with paying debts with hard money is that it could trigger a depressionary cycle, particularly when the economy is losing traction.

“So, throughout history, paying back with hard money eventually was abandoned, and you print money,” he said.

“That is what 71 was, that is what March 1933 was and so on,” he added.

Ray Dalio demystifies debt for the investor

“What you have got to think about is how much money one has in debt instruments and whether you want to own them as assets. I think they are bad assets,” he said.

So Ray Dalio believes inflation will persist due to the deficit funded with soft money. In other words, inflation will be higher than treasury yields which will not be a haven against stagflation.

“What you have got to think about is how much money one has in debt instruments and whether you want to own them as assets. I think they are bad assets”

RAY DALIO

Ray Dalio said investors need to diversify.

“You have to ask what is money, we are seeing a variety of money, different types of money will compete in the environment we are in,” he said.

“For some, maybe it is crypto, or maybe it is gold for others, it is other things. Maybe the Digital Renminbi can compete with the US dollar,” he said.

“Think about how much money is being stored in debt instruments. Think about how poor those returns are, so that kind of a shift is very important,” he said.

“All currencies have a lot of debt, so when you look at one relative to the other there will be a lot of printing. Currency equals debt, and when you are holding a currency you are holding a debt instrument. So all of those will decline in value relative to other things,” said Ray Dalio.

“Currency is a medium of exchange, and a stronghold of wealth and its store of wealth is a problem, particularly for the USD” – Ray Dalio

Ray Dalio noted India has a direct link with Russia on the currency. India needs commodities, and the Ruble is a commodity-based currency, so it makes sense for India to store some of its foreign reserves in Rubles and collect interest at 17%. Despite unprecedented sanctions on Russia, betting on a Ruble crash is unlikely because it is a commodity-based currency. Moreover, unlike Iraq, Russia’s sovereign borders are underwritten with nukes.

“Currency is a medium of exchange, and a stronghold of wealth and its store of wealth is a problem, particularly for the USD,” said Ray Dalio.

“That is why you have inflation as money goes into other things,” he said.

So it is the printing of US dollars and a currency backed by debt that is no longer attractive explains why Ray Dalio rates his concern on inflation at eight, from a scale of one to ten.

Ray Dalio demystifies debt and highlights a self-reinforcing paradigm shift taking place

Ray Dalio believes that the 40-year bull market in treasury bonds has ended.

So there is no alternative TINA that no longer applies in a multi-polar world. Ray Dalio believes demand for treasuries is likely to fall, pushing yields higher, thereby increasing borrowing costs and inflation.

“So interest rates have to rise a lot or the Federal Reserve has got to come in there and buy more,” he said. But as the Fed prints more to buy more debt, which debases the currency causing more inflation.

“When you raise the return on cash and bond, that makes other assets less attractive, particularly long duration tech assets, so it produces that squeeze,” he said.

“What you have is enough tightening by the Fed to deal with inflation adequately but not too much tightening for the markets and economy,” he said.

“So Fed is in a difficult place one year from now as inflation remains high and it starts to pinch on both markets and economy,” he added.

“I think we are going to have periods of stagflation, and then you are going to need to understand how to build a balanced portfolio for that kind of environment” – Ray Dalio

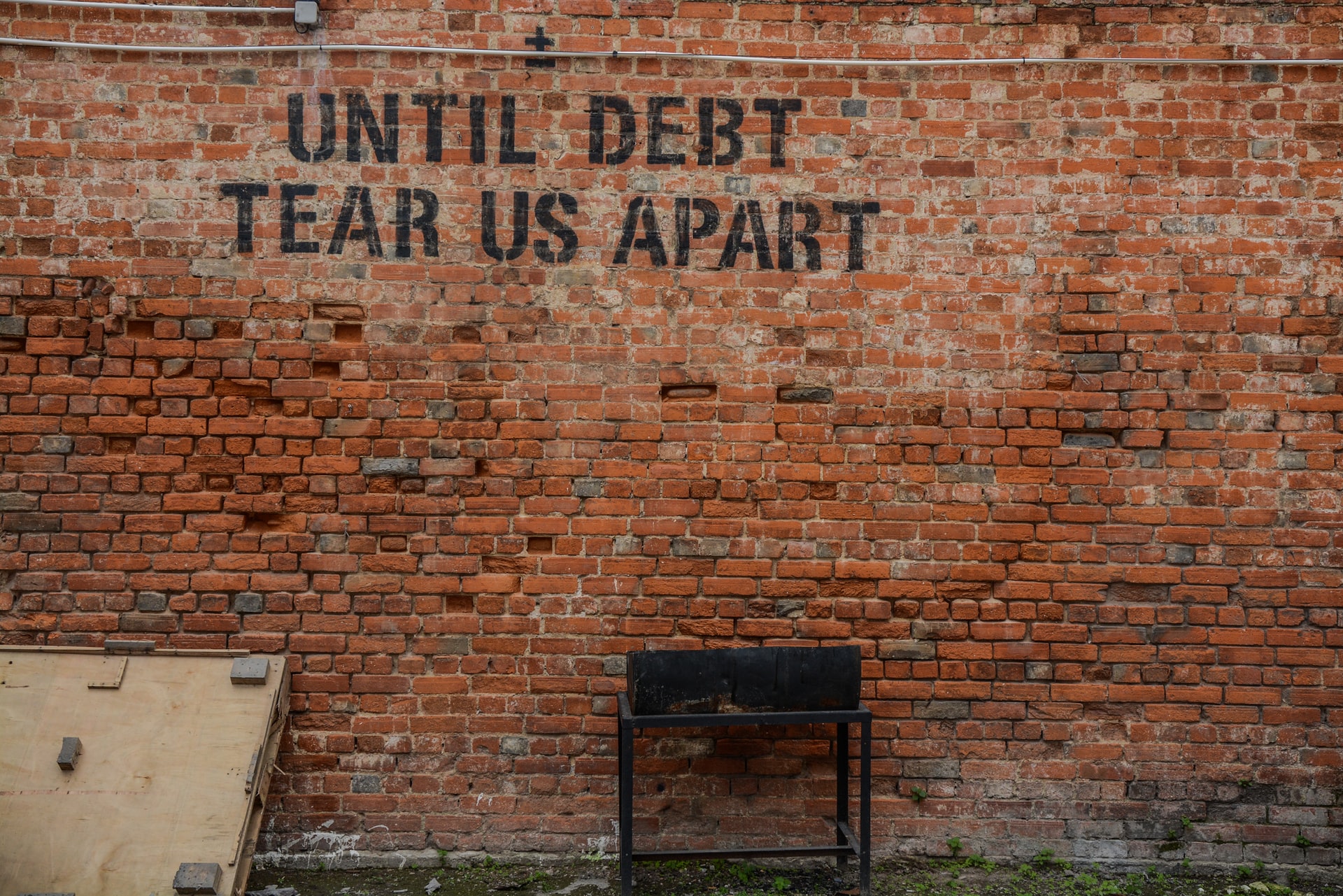

Ray Dalio sees a stagflation environment as they try to pay down the debt by navigating between hard and soft money. Two-high inflation could tip the economy into a depression and stresses social cohesion.

Ray Dalio notes that we are already in an environment of more debts than earnings. “One man’s debts are another man’s assets. Imagine holding a bond and looking at how much money is in bond funds and cash. In case you don’t get any interest rates to compensate for inflation and bond funds you get negative returns,” he said.

So Ray Dalio demystifies debt believing that it is a dynamic beyond the central bank’s capacity to deal with unless they change the fundamentals.

“I think we are going to have periods of stagflation, and then you are going to need to understand how to build a balanced portfolio for that kind of environment,” he said.

There is a relationship between cash, bond yields, and equity returns, so every investment in exchange for a lump payment for future cash flow.

“Stocks have expected returns not much more than cash, so as that happens, why should I have equities with the volatility,” he said.

Ray Dalio also warned of a large wealth gap, an opportunity gap that could lead to internal conflict. He recommends redistribution of opportunity to make people productive and limit internal conflict ,which is disruptive to the economy and social stability.

“You have to have an economy that is a fair system and have productivity,” he said.

“Political polarity is so great that neither side might accept the 2024 election result. We may find ourselves where democratic rules or order may no longer apply,” he said.