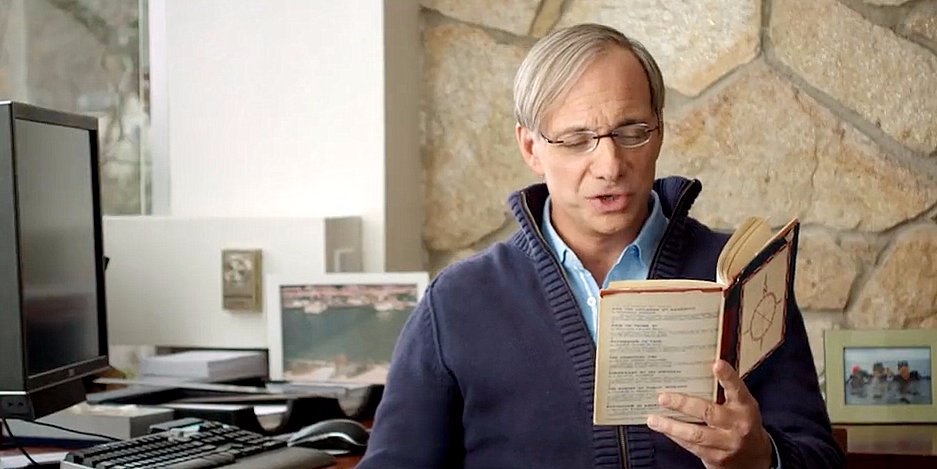

Ray Dalio, Chairman and Chief Investment Officer at Bridgewater Associates (the world’s largest hedge fund with $122 billion of assets currently under management), also known as the hedge fund king has taken to LinkedIn to shed some light on the biggest economic and social-political issues of our time.

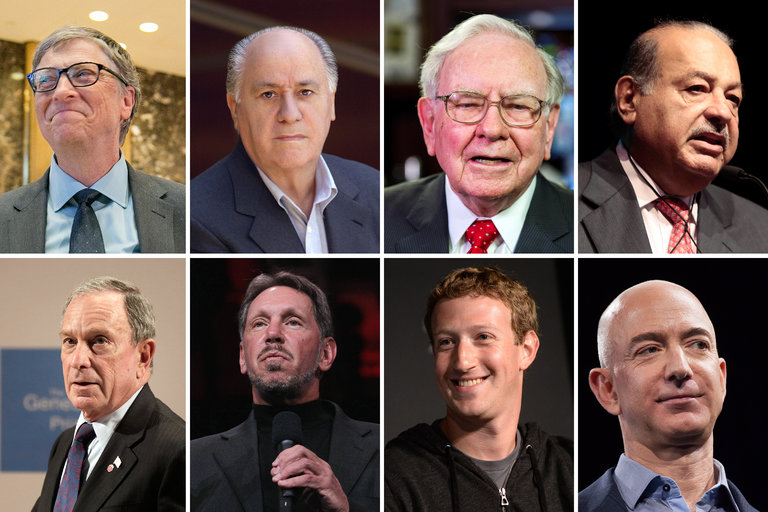

Here is Ray Dalio’s LinkedIn post published on October 23, 2017, entitled Our Biggest Economic, Social, And Political Issue. The crux of Dalio’s piece is that a widening wealth gap and income inequality have contributed to a two-tier economy which is also causing social and political challenges. But is Dalio shedding light on anything new, after all just 8 men own the same wealth as half the world?

“The wealth of the top one-tenth of 1% of the population is about equal to that of the bottom 90% of the population, which is the same sort of wealth gap that existed during the 1935-40 period”

RAY DALIO

You don’t need to be a news junky to figure out that something is wrong.

Retailers in the world’s largest consumer economy, the US are having a dismal year with store closures reaching 8,000. US retailers are calling it the retail apocalypse. Online sales are not making up for the shortfall in consumer spending.

So despite the US’s record low October unemployment rate of 2.7% hourly earnings have been in a decline for 6 months in a row.

But dig deeper into the unemployment data and you’ll figure out why. In a few words, millions of working age people who are structurally unemployed (out of work for 6 months or longer) have been statistically eliminated from the unemployment data.

So the official data is skewed (cooked).

“Giving money to be used for consumption will merely diminish the value of money and not increase the size of the pie”

RAY DALIO

While we are seeing an unprecedented expansion of the global middle class. For example, China’s middle class is exploding and that is propelling Chinese consumption at a rate of 14 percent a year. However, middle-class prosperity in many of the advanced G7 economies is in retreat.

“The wealth of the top one-tenth of 1% of the population is about equal to that of the bottom 90% of the population, which is the same sort of wealth gap that existed during the 1935-40 period” as Dalio writes.

Why?

Let me keep this simple. Let’s say you are high up the food chain, connected and have access to cheap fiat currency. So 50 million dollars is put into your bank account at 1% interest. What would you do? Buy a housing complex, invest in a mining company, buy bonds, maybe even junk bonds too with big yields?

It is a no-brainer. Think about it. The central bank’s asset purchase program is virtually underwriting the investment, keeping prices high and ensuring capital appreciation on your investment.

Whats’more, even if you fail, say those risky high yielding junk bonds end up worthless but you are feasting at the king’s table then you can always ask for a bailout. In a few words, it is indeed a rigged system. The revolving doors between Goldman Sacks and the central banks, lobby groups and government ensures that monetary policy, government policy are all working in tandem to serve the interests of the top one-tenth of 1%. Democracy (rule by the people) has been superseded by plutocracy (rule by the wealthy).

Meanwhile, for the vast majority of the population (the dwindling western middle class) they see their savings being depleted due to hyperinflationary monetary policy (cost of education, housing, and healthcare are all spiraling).

Furthermore, dismal interest rates on deposit savings account and near-zero bond yields are further impoverishing pensioners in their old age.

“The polarity in economics and living standards is contributing to greater political polarity” Dalio wrote. “It is also leading to reduced trust and confidence in government, financial institutions, and the media, which is at or near 35-year lows” – Ray Dalio

“While conditions for the lowest income groups have long been bad, conditions of non-college-educated whites (especially males) have deteriorated significantly over the past 30 years or so,” Dalio said. “This is the group that swung most strongly to help elect President Trump.”

What then is the solution, according to Dalio?

“If I were running Fed policy, I would want to keep an eye on the economy of the bottom 60%,” said Dalio. Dalio wrote. “By monitoring what is happening in the economies of both the bottom 60% and the top 40% (or, even better, more granular groups), policymakers and the rest of us can give consideration to the implications of this issue.” His solution is “some mix of directing resources so that they are used productively to generate more than enough income or savings in order to pay for themselves and b) productive wealth transfers appears inevitable.”

What is Dalio’s view on universal income?

Basically, Dalio rejects the universal basic income proposal advocated by the likes of billionaire Facebook CEO Mark Zuckerberg.

“Giving money to be used for consumption will merely diminish the value of money and not increase the size of the pie” – Ray Dalio

In short, there doesn’t seem anything that is likely to halt the continuing downward trajectory of middle-class real wages, disposable income and living standards in advanced economies. In fact, an emergency monetary policy which includes quantitative easing QE and near-zero interest rate policy ZIRP is actually widening the wealth gap and accelerating the decline of the middle class in G7 economies, even the central bankers admit this publicly now. On the other hand, for the middle class in emerging economies, the situation looks brighter.

Is this being financially engineered? If the goal is to standardize wages globally then wages in G7 economies would need to fall and wages in emerging economies would need to rise and that precisely is what is happening.

Moreover, why would the Fed disrupt the current dynamic in play, after all the Fed is a multinational corporation, its product is debt. So with a younger more dynamic market in emerging economies to exploit that probably suites their business model just fine.

So the Brady Bunch trade short the middle class, poor in advanced economies and long the rich is likely to play out going forward.

‘Leonardo da Vinci artwork’ sells for record $450m, meanwhile the middle class has been downgraded to pound/dollar store discount shoppers.

Can you see the picture emerging?