Ray Dalio warns of economic big sag at his latest IMF Annual meetings.

He presented his views within the framework of his 1930s Analogue where he argues that there are several factors today which make the investing environment similar to that of the 1930s.

“Ray Dalio warns of economic big sag at his latest IMF Annual meetings.”

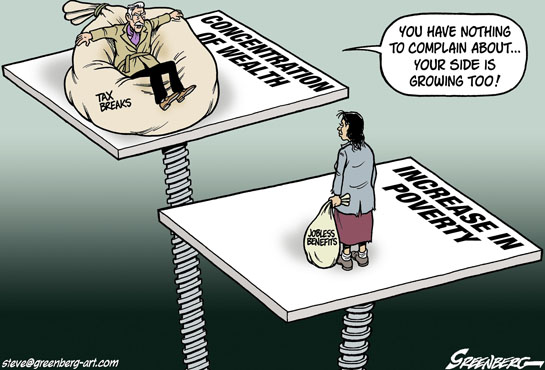

Ray Dalio warns of economic big sag by first highlighting to his wealthy audience about the greatest wealth gap since the 30s in the US

“The top 1% has a net worth of approximately equal to the bottom 90% and so we have a large wealth gap. China has got a large wealth gap” said Ray Dalio.

“With that, we have greater political polarity since the 1930 and we have a situation where we don’t have much ability to use monetary policy” he said.

“And like the 1930s we have a rising power challenging existing world power in the form of China-US challenges” added Ray Dalio.

“There are four kinds of the war there’s a trade war, there’s a technology war. there’s a currency capital war and there is a geopolitical war” he said.

“The top 1% has a net worth of approximately equal to the bottom 90% and so we have a large wealth gap”

RAY DALIO

Ray Dalio warns of economic big sag because the expansion period is nearing the end

“This is the best we can do” said Ray Dalio. But in the next downturn, elections could bring about greater political extremities during a period when monetary policy will be less effective warned Ray Dalio.

“There has to be coordination, but how do we get that in this type of environment” he said. Ray Dalio is referring to coordination between Fiscal and monetary policy.

“A decade of easy credit has left corporate balance sheets in a dangerously levered state” – Ray Dalio

Ray Dalio warns of economic big sag and advises investors to remain cautious on stock and corporate credit

“A decade of easy credit has left corporate balance sheets in a dangerously levered state” he said. “So that creates a big sag then it is likely to create a big bust” he added.

Here is what Ray Dalio had to say on corporate credit…

As interest rates went down a lot of money’s available and the return on equity was higher than the return — the cost of funds. There has been a lot of buying leveraging up.

Essentially you can borrow money with hardly any interest rate and almost the promise that you will never have to pay back principal because you’ll keep rolling it over.

So the notion is like you can borrow the money and if that you don’t have to roll over the principal, you don’t have any interest, you don’t have much in the way of debt service payments. So now you look at that and you say that’s pretty wild. That’s pretty crazy. And that is — there were elements of that existing and of course. But you have a lot of — you’ve limited, you’ve reached the limits almost of that being able to happen. And then you have those obligations so that creates this big sag — then it’s likely to create a big bust.