Ray Dalio’s spiraling bond yields will trigger the next crisis is a bearish view, and it is in good company. Bill Gross and Jeff Gundlach, two billionaire bond fund managers, spoke early in the year about the prospect of the coming bond bear market.

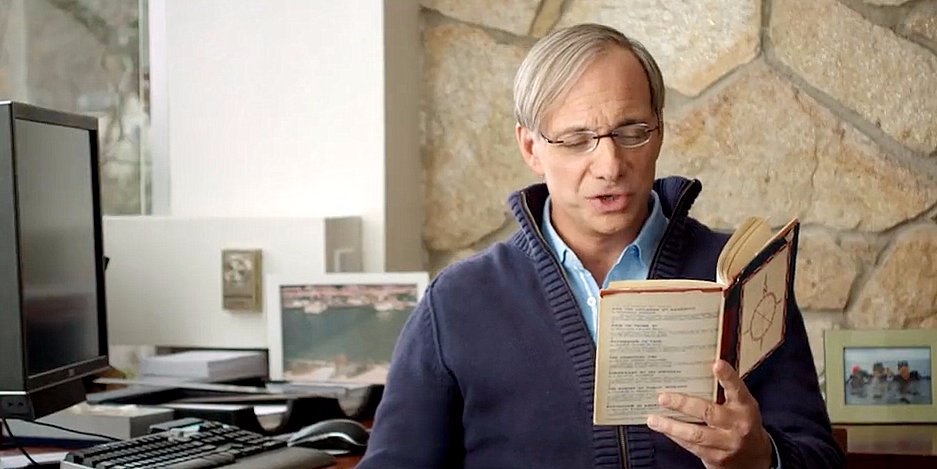

“A 1 percent rise in bond yields will produce the largest bear market in bonds that we have seen since the 1980-81 period” said Ray Dalio in Davos early this year.

Perhaps the headline of the week, maybe even the year, is that in the first week of October 2018 approximately 1.2 trillion dollars of paper value has been wiped off global bond fund investments.

Heavy selling on the bond market sent the Treasury 10 Year yields spiraling to an all-time year high of 3.23% (October 5). Treasury 10 Year yield is now getting close to the threshold level of 3.25% when rising yields trigger risk-off.

“I think if they (Treasury 10 year yields) only go to 3.25% for the rest of the year then stocks might be up” – David Tepper.

“A 1 percent rise in bond yields will produce the largest bear market in bonds that we have seen since the 1980-81 period”

RAY DALIO

But the Fed’s over hawkish stance supports Ray Dalio’s spiraling bond yields will trigger a next crisis thesis. Paradoxically, a US economy firing on all cylinders could spell trouble for these frothy asset prices (albeit short term).

Why? The Fed’s monetary accommodative stance, what once seemed to be an endless pillar of support for the financial market, is now being pulled away.

Fed Chairman Jerome Powell’s recent speech underscores a Fed policy transition from accommodative to normalization.

“The really extraordinarily accommodative low-interest rates that we needed when the economy was quite weak, we don’t need those anymore” said Powell.

“They’re not appropriate anymore. We need interest rates to be very gradually moving back toward normal.”

“The really extraordinarily accommodative low-interest rates that we needed when the economy was quite weak, we don’t need those anymore”

JEROME POWELL

“And that’s what we’ve been doing now for basically three years, and interest rates have just now in real terms [adjusted for inflation] moved above zero,” he said.

“Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral – not that they’ll be restraining the economy” said Powell.

But there is no elegant way to pop a bubble so Ray Dalio’s spiraling bond yields will trigger a next crisis has legs. The Fed policy of “gradually moving back toward normal”, in other word adjust the Fed fund rates to 2% and 2.25% target and the Fed unwinding its massive trillion dollar assets on its balance sheet has already caused an emerging market currency storm.

In September, approximately one trillion dollars was wiped off emerging market stocks; that was the first bubble to pop. Then in October, this month, the bond market bubble popped, wiping a further 1.2 trillion dollars off bond value investments.

“Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral – not that they’ll be restraining the economy” – Jerome Powell

So, Ray Dalio’s spiraling bond yields will trigger a next crisis view is no voice in the wilderness.

Stan Druckenmiller also believes that a“massive debt problem” will ignite a crisis and Citadel’s Ken Griffin sees a credit binge ending badly.

As I wrote previously, the Fed’s greatest monetary easing experiment in the history of finance will not end without meaningful consequences.

Every Fed tightening cycle has created a crisis. In 2004-6 Fed, tightening seemed normal, but subprime mortgage-backed securities were the first bubble to pop, which then triggered a US housing collapse, set off contagion and that nearly collapsed the global financial system.

In the late 1990s, the Fed started tightening; that triggered the Asia crisis, LTCM, and the Russian collapse, and the equity bubble popped. Early 1993-4 Fed tightening caused a similar bond market turmoil and the Mexican crisis. Then in 1987 Fed Greenspan’s tightening followed Black Monday and the ‘the Greenspan put’ took off. The early 80s included the LDC/Latam debt crisis and Conti Illinois collapse.

Bringing asset prices down will be one of the consequences (intentionally or unintentionally) of the Fed’s plan back to monetary normalization and it is likely to start with bonds. So it should come as no surprise then that this rate hike cycle in conjunction with the Fed unwinding its massive balance sheet, Quantitative tightening (QT) could cause assets prices to hit price discovery with a thump.

“Giving money to be used for consumption will merely diminish the value of money and not increase the size of the pie” – Ray Dalio

Ray Dalio’s spiraling bond yields will trigger the next crisis and the Fed’s QT has its fingerprints all over it.

The latest release of the Fed’s balance sheet (October 4, 2018) sheds light on why the bond market recently crashed sending yields soaring.

The Fed Total Asset Weekly chart reveals it all.

Over the four-week period from September 6 through October 3, total assets on the Fed’s balance sheet dropped by $34 billion. This brought the decline since October 2017, when the QE unwind began, to $285 billion. At $4,175 billion, total assets are now at the lowest level since March 5, 2014.

During QE, the Fed bought Treasury securities and mortgage-backed securities (MBS). During the current era of “balance sheet normalization,” the Fed is shedding those securities.

So the QE unwind or QT was still in ramp-up mode during September, according to the latest release of the Fed’s balance sheet.

The recent “turbulence” in Emerging markets and now in the bond market is of the Fed’s making and it is a reminder to investors/traders that we still live in the era of central bank “managed” markets.

The Fed, the world’s central bank by default, gets to decide the precise date when to crash these markets and for how long and in so doing the Fed( indirectly) can have an impact on the outcome of political elections.

If you are of the opinion that the Fed is politicized then Ray Dalio’s spiraling bond yields will trigger the next crisis just as the US electorate heads for the midterm elections.

If you believe otherwise, then the Treasury ten year bond yield will be “managed” below 3.25% and the stock-mark sell-off will be just a seasonal healthy correction, a buying opportunity.