Bill Miller’s melt-up theory is a contrarian view, bearing in mind that two-thirds of American CFOs fear a recession by the third quarter of next year, according to the latest Duke CFO Global Business Outlook Survey, released Wednesday.

Bill Miller’s melt-up theory of stocks rallying 30% didn’t play out in 2018

“Bill Miller’s melt-up theory of stocks rallying 30% didn’t play out in 2018”

A meltup is frequently defined as a sharp and unexpected rise in the price of an asset class, driven largely by a stampede of investors who are more concerned about missing out on a big up move than by improving market fundamentals.

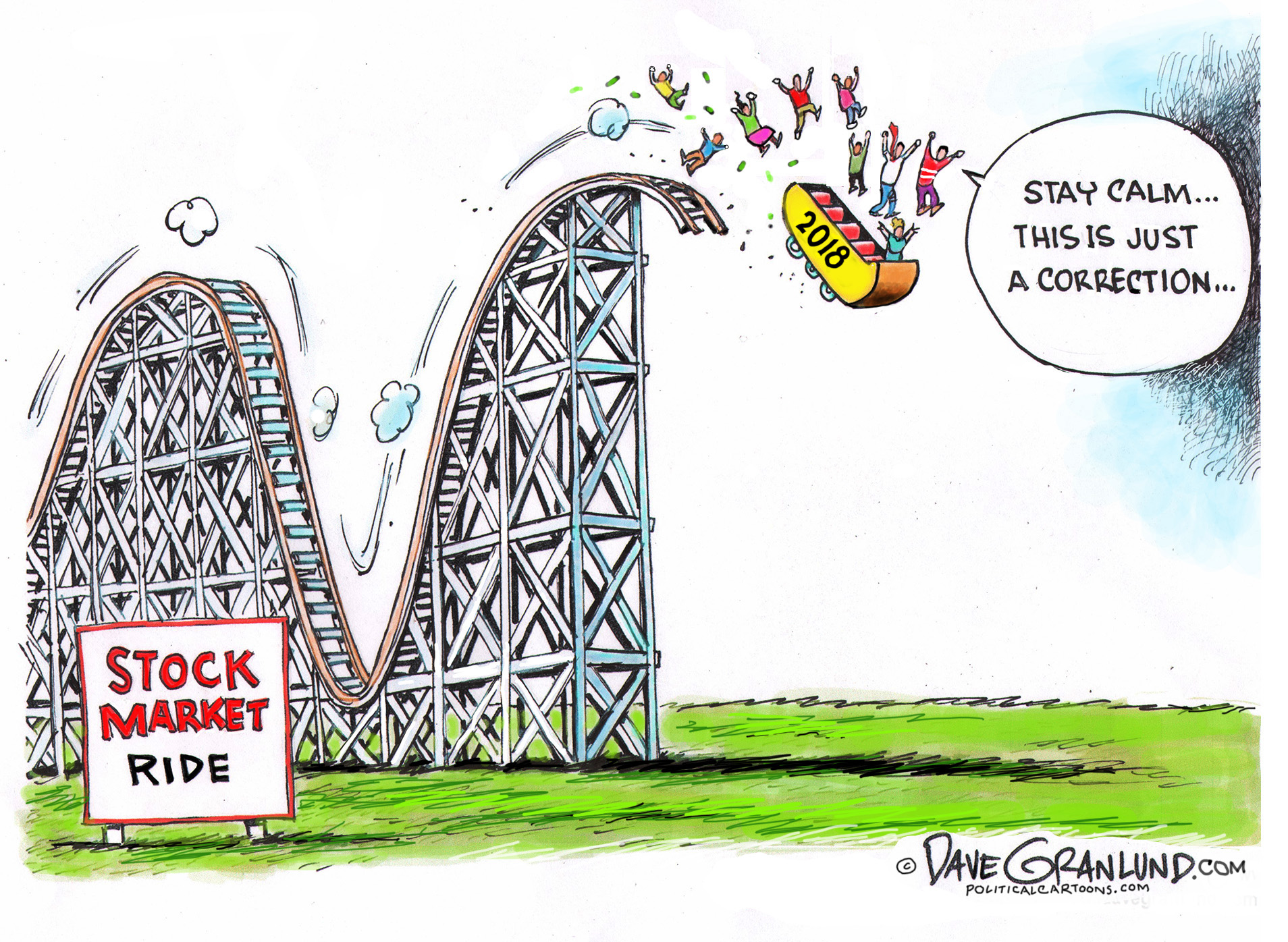

In fact, 2018 was the worse year for stocks in 10 years.

Here are the facts. “The Dow fell 5.6%. The S&P 500 was down 6.2% and the Nasdaq fell 4%. It was the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. (The S&P 500 and Dow were down slightly in 2015, but the Nasdaq was higher that year.)”, according to CNN business.

Bill Miller’s melt-up theory, a year ago, argued that stocks would have a kind of melt-up similar to 2013, where the market popped higher about 30 percent”

The mechanics of Bill Miller’s 30% stock market melt-up is based on the flow or rotation of capital from bonds into equities.

“2018 was the worse year for stocks in 10 years”

But Bill Miller‘s melt-up theory failed to materialize in 2018 and stocks experienced more of a meltdown, particularly in December.

Nevertheless, despite stocks, lackluster performance last year the world’s largest asset manager Larry Fink from BlackRock is warning investors to standby for stock market melt-up, not a meltdown.

“stocks are knocking on the door of records, a surge to the upside appears more likely than a market collapse” – Larry Fink

Larry Fink argues that Bill Miller’s melt-up theory will play out in 2019 for a different reason

Chief Executive Larry Fink says that stocks are knocking on the door of records, a surge to the upside appears more likely than a market collapse. That is because so many investors still have lots of cash to put to work, the head of the world’s largest asset manager told CNBC in an April 16 interview.

The 2018 fourth-quarter sell-off pushed almost pull stocks into a bear territory but since then stocks have rallied. For the year to date, the S&P 500 is up 15.9% and is just less than 1% below its all-time closing high of 2,930.75 set Sept. 20.

“since Bill Miller’s melt-up theory was put forward the yield curve has inverted. The inverted yield curve warning is a great recession predictor which investors would choose to ignore at their own peril”

Perhaps Bill Miller’s melt-up theory took place in the first quarter of 2019

Will the fear of missing out trigger the great rotate out off cash accounts, bonds and into stocks?

Since Bill Miller’s melt-up theory was put forward the yield curve has inverted. The inverted yield curve warning is a great recession predictor which investors would choose to ignore at their own peril.

Bill Miller’s melt-up theory playing out in 2019 could be far fetched

Why take risks when stock prices are bubbly, given the fundamentals when decent yields can be gained in US treasuries taking minimal risks.

So if Bill Miller’s melt-up theory already expired in the first quarter of 2019 then the meltdown could be next, central bank permitting.