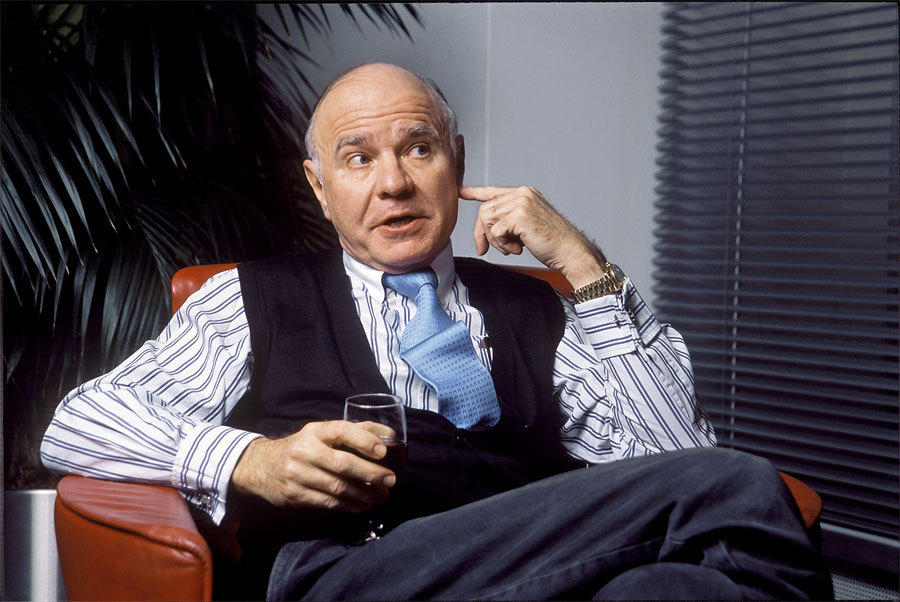

Marc Faber sheds light on global stock markets and how to invest in times of unprecedented monetary inflation, which is likely the next chapter in the saga, following a decade of unprecedented monetary easing taken to surreal levels in the 2020 lockdowns.

If all this sounds mind-boggling and concerning, all at the same time, maybe it explains why gold, the oldest and best bet against jaded double-down policies, keeps making new highs in 2024.

Buy gold, face the madness, and dance was one of our tips in December 2023 for 2024, and if you did it, you’re dancing.

“a decade of unprecedented monetary easing taken to surreal levels in the 2020 lockdowns”

WEALTH TRAINING COMPANY

Marc Faber sheds light on US stock valuations

He noted that some investors believed the US stock market capitalisation represented 50% of the world capitalization. “But then I saw statistics that said the US is 70% of the world stock market capitalization,” he said.

“Assuming it is anywhere between 50 and 70%, the fact remains that the US has a population of 330 million people, which is less than 5% of the world population,” said Marc Faber

Here is the takeaway: “This implies that the rest of the world is inexpensive,” he added.

It would be wise to keep an eye on those emerging market ETFs.

He believes advanced Western economies have peaked due to an ever-encroaching government in a heavily regulatory environment where growth is amongst the oligopolies.

“So Home Depot grows at the expense of mom-and-pop shops until it becomes so big that it can not outgrow the industry anymore,” he said.

“I believe the magnificent seven and semiconductor stocks are highly valued,” he added.

“I believe the magnificent seven and semiconductor stocks are highly valued”

WEALTH TRAINING COMPANY

Marc Faber sheds light on analysts, believing they excel at making unrealistic forecasts

In 2000, analysts thought Cisco would be an industry leader.

In reality, Cisco didn’t perform, and its stock is still lower than in the 2000s.

“In a recent example, in 2020 and 21, the Ark Innovation Fund, run by Cathie Wood, who said her fund would outperform everything else going up 15 to 20% per year, made these claims repeatedly,” he said.

“The SEC was standing back and doing nothing, which leads me to believe that the SEC is one of the most corrupt institutions in the world, and they do not protect the interest of the small investors but interest groups,” he added.

Marc Faber believes we have a financial bubble where sales forecasts are overestimated. Analyst forecasts do not take into consideration new competition and innovations.

“If stocks and the home market drop 50%, it causes huge economic damage”

– Marc Faber

Marc Faber sheds light on monetary inflation

Everything is very complex in an environment of monetary inflation

He believes we are at an inflexion point in asset inflation, the latter the Fed pays no attention to.

“When home prices and stocks go up, the Fed doesn’t do anything about it.

As long as the CPI doesn’t go up a lot, they don’t care when the stock market goes up, but they care when it goes down,” he said.

“For the last 30 to 40 years, we have had pronounced asset inflation.

Most people in advanced economies don’t earn enough to buy homes.

The affordability of buying homes at present, statistically compared to people’s incomes, is at the lowest level in history in the US,” he added. Marc Faber believes the Fed knows this, but they cannot deflate the housing market because everyone is used to asset inflation. “If stocks and the home market drop 50%, it causes huge economic damage,” he said.

Marc Faber sheds light, explaining that the central bank fiat debt system is in a self-inflicted difficult situation.

“They boosted asset prices, and now they cannot tighten monetary conditions sufficiently to bring down asset prices without causing sufficient damage,” he said.

Marc Faber noted that the absolute level of interest rates doesn’t tell you whether monetary policy is tight or not.

In Turkey, interest rates went to 100%, and they have dropped to 60%,

So you could have very high interest rates and still have loose monetary policy. You can also have a tight monetary policy when interest rates reach 3%, similar to Japan.

He noted that the current 35 trillion public deficit, which keeps growing, is just the tip of the iceberg. Future government promises to pensioners and veterans the unfunded liabilities are significant.

“If someone has savings, holding some of it in gold instead of cash is desirable” – Ray Dalio

Where next, Marc Faber sheds light

“The US can do three things, cut government spending and impose austerity, but with social cohesion near breaking point, they may not have much wriggle room for that. “Go and try saying to military veterans, policemen, firemen we can’t pay your pensions, you would have a revolution in America,” he said.

Tell the electorate that taxes will have to rise, nobody will be elected.

The third option is inflation caused by excessive gov spending, and the central bank to finance government spending,” he said.

Fiscal deficits and expansionary monetary policy lead to inflation.

At present, we are already in recession.

The fourth option nobody feels comfortable discussing is another Great Depression, WW3 and a massive default.

He thinks we could see a bond market rally for three or six months.

But he asks, “What if the government inflation data is wrong?”

Marc Faber sheds light on where to invest in these turbulent times

He believes that Gold is an obvious investment in the environment of money printing.

“If someone has savings, holding some of it in gold instead of cash is desirable,” he said.

He sees a monetary inflation supercycle where the Fed and other central banks have no other option, but to print money. Otherwise, the system collapses.

Moment asset prices turn down Wall St, the Fed to ease monetary conditions.

He has a diversified portfolio of shares. He has a large portion of his funds in fixed-income securities of varying maturity dates.

But he notes monetary inflation factors into the equation maturity risk of holding long-dated bonds.

“If you can put your money in a cash deposit at 5%, it may not make money, but it could be the best option. Think of where you will lose the least money,” he said.

Want the latest investor news as it happens?

Subscribe to our Investors Newsletter