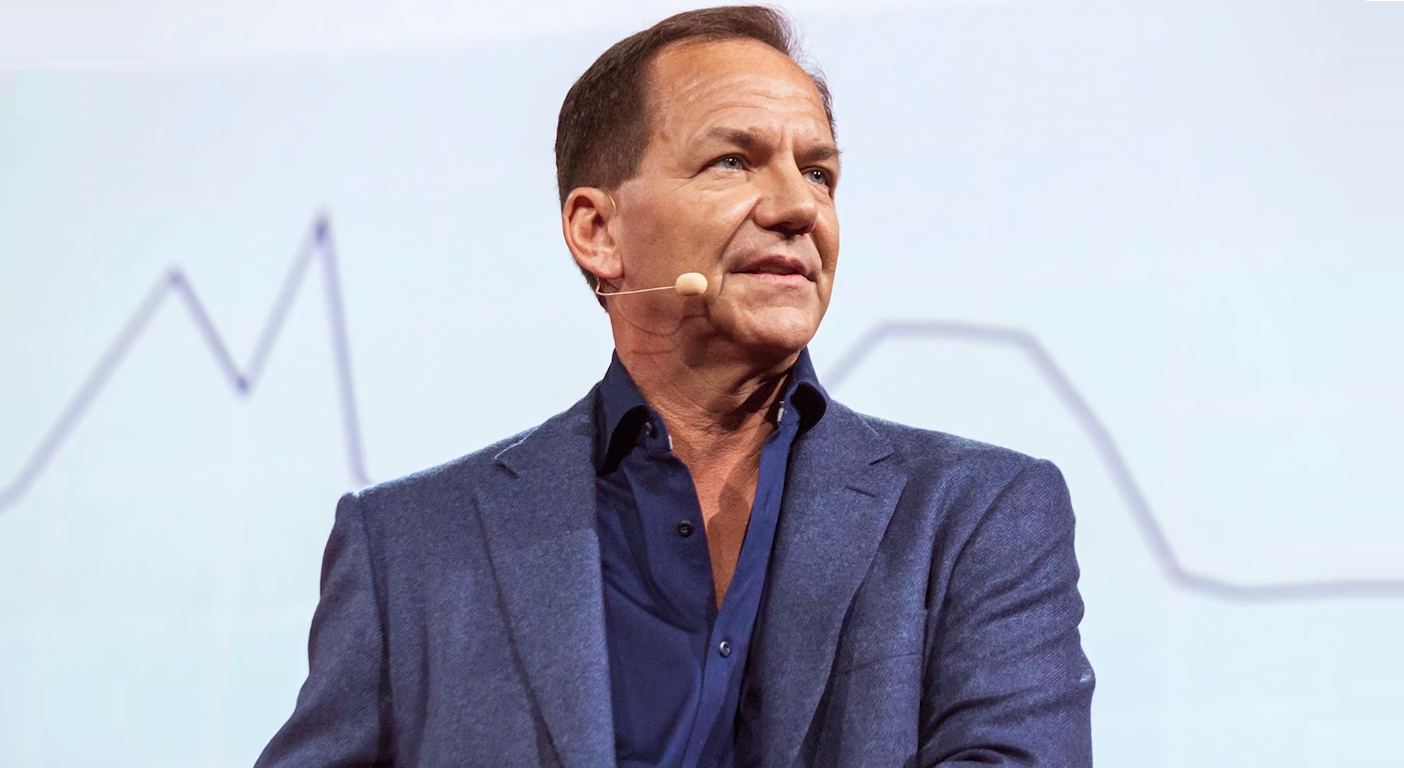

Paul Tudor Jones radar watch features geopolitics glowing on his screen.

The Billionaire founder of Investment Corporation views contemporary geopolitics as the most threatening he has ever seen.

Indeed, last year was the first time since WW2 that we saw the invasion of a European sovereign country with Russian tanks rolling across Ukraine’s sovereign borders.

The bombings of civilian infrastructure and homes on Europe’s continent, with nearly half a million people killed, was something that most of us thought was assigned to the history books.

Russia is now the largest single-army in Europe. Ukraine’s NATO-backed equipped and armed army has fallen, something the mainstream will not admit. Ukraine’s Spring counter-offensive failed, and human resources have been spent. Assault rifles are useless without soldiers, and tanks also need tank operators. Sending more equipment to Ukraine could now result in the transfer of military technology, which could be used against NATO forces.

“The Billionaire founder of Investment Corporation views contemporary geopolitics as the most threatening he has ever seen”

WEALTH TRAINING COMPANY

Europe’s entire security architecture has changed since the 2022 Russian-Ukrainian war

Are we seeing Russian militarism to rebuild its Imperial past?

Some would cite the 2008 Russian-Georgian War, the 2014 Russian-Crimea War and the 2022 Ukraine invasion as evidence of military expansionism.

Others would argue that it was NATO’s five-time encroachment near Russia’s border that caused the bear to crawl from its territory and charge.

But whether Russia is rebuilding its Empire through military expansionism or is acting out of self-defence is not the real question for investors.

It took NATO more than a decade and billions of dollars to train and equip Ukraine to fight Russia, while the latter was spending energy to make peace through the Minsk agreement. So Russia was planning for peace, while Ukraine, a proxy state, equipped, and trained by US-NATO, was planning for war.

When Russia eventually went on a war footing it destroyed Ukraine in less than 18 months and shattered the myth of Western military superior technology.

“Are we seeing Russian militarism to rebuild its Imperial past? ”

WEALTH TRAINING COMPANY

So Paul Tudor Jones radar watch features geopolitics glowing because there is nothing that could truly stop the advance of Russian tanks into any European country. If Russia wants to continue rolling its tanks towards Western Europe, for whatever reason, it can. There is no single army powerful enough to stop it. As an investor, that is your greatest fear. An invasion could mean you could potentially lose everything.

Real estate could be destroyed in war or confiscated by the invading country. Sovereign bonds also become worthless.

In the age of nuclear war, NATO could be not much more than the alliance of the wobbly knees. Self-preservation in the age of Mutually Assured Destruction MAD means that the UK, France or the US is unlikely to stick their neck out for any other country in Europe, or elsewhere, when facing a nuclear adversary. That is the reality of self-preservation.

So, how can you invest in Europe when Russian intentions are unclear?

“War in Europe is bad enough, but now investors are dealing with another conflict hot spot in the Middle East” – Wealth Training Company

Multi-front war in the Middle East flares up as Paul Tudor Jones radar watch features geopolitics

War in Europe is bad enough, but now investors are dealing with another conflict hot spot in the Middle East with Hamas’s bloody invasion of Israel and Israel bombing and ground invasion of the Gaza strip.

Israel happens to be surrounded by neighbours who hate them and frankly wish they would disappear off the map.

Lebanon is firing rockets into Israel, and Israel is replying in kind.

Iran has warned of the inevitable expansion of the Gaza-Israel war.

The Middle East Gaza-Israel war is a tinder box that could potentially ignite the entire Middle East region.

“Where this gets bad is obviously if Iran and Israel get into direct conflict because then you can have kind of a First World War cascade, where everyone gets involved,” said Paul Tudor Jones.

“The big question now is if Hamas was a proxy for Iran or was it simply an ally,” he added.

Geopolitical instability in the Middle East impacts the price of oil and inflation and interest rates.

Paul Tudor Jones radar watch features a recession

The billionaire also predicted a recession early next year.

Delinquency rates and bankruptcy auto loan repossessions are currently at levels not seen since the 2008 Great Recession.

The recession has already started.

“The country needs to find $1 trillion in savings by 2025 and should raise taxes and cut spending” – Paul Tudor Jones

Paul Tudor Jones believes the US is in its weakest position since World War II and predicts a recession will start in the first quarter of 2024.

He cites the US’s weakest fiscal position since World War II.

The US National debt is fast approaching 34 trillion dollars.

Moreover, the estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of October.

That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.

“The country needs to find $1 trillion in savings by 2025 and should raise taxes and cut spending,” said Paul Tudor Jones.

The imbalance in the treasury market is also on Paul Tudor Jones radar

In other words, the public deficit is likely to be financed with the creation of more treasuries.

But demand for those treasuries is waning despite the higher yields.

The latest auction for 30-year Treasurys was weak, which also sent the yields surging. The 30-year U.S. Treasury yield climbed above 4.8% last week from 4.655% the prior day, after a sale of $24 billion in bonds.

So, the supply of treasuries is going higher. Meanwhile, the demand for those treasuries is weakening.

received far less demand from investors than the government is used to

“The bond market, simply through supply and demand, is going to deliver more rate hikes because we don’t have a clearing price yet for long-term debt,” Jones said. “So those rate hikes are probably going to tip us into recession,” he said.

So the treasury market will force the rate higher, not the Fed, which is what I have been forecasting.