Peter Schiff’s recession fated view was recently aired on RT Boom Bust talk about the Fed and its impact on the market.

“No matter what the Fed does, a recession is coming” said Peter Schiff.

Peter Schiff’s recession fated view is based on the Fed cutting rates to try to keep the air from coming out of the stock market bubble. Peter Schiff, gold bug permabear has good reason to smile these days with the shiny yellow precious metal, gold up 16.29% against king dollar a year to date. Investors are saying in gold we trust.

“No matter what the Fed does, a recession is coming”

PETER SCHIFF

Peter Schiff’s recession fated view is based on the Fed, the world’s central bank by default eventually failing to keep the bubble inflated

“The other reason is they’re trying to keep this so-called expansion going. There they’re going to fail. I think we’re headed for recession regardless of what the Fed does with rates. The only thing the Fed is going to succeed in doing is reviving inflation. The Fed claims inflation is too low and they want to make sure the rate goes up. Well, that’s going to be their only success. But unfortunately, that’s also going to be their biggest failure” said Peter Schiff.

“This isn’t even a good economy” hence Peter Schiff’s recession fated view.

“The president tweets every day that we have the strongest economy in history, which isn’t even close to being true. But clearly, Powell doesn’t believe that the economy is the strongest in history, because if he did, he’d be raising rates, not cutting them” said Peter Schiff.

“The president tweets every day that we have the strongest economy in history, which isn’t even close to being true”

PETER SCHIFF

“It’s a bubble. Powell doesn’t seem to understand that. He seems to think the economy is doing OK. It’s not. The economy today is in worse shape than it was before it collapsed in 2008″.

“The Fed inflated a much bigger bubble this time than it did last time. And yes, the longer we succeed in kicking the can down the road, the greater the imbalances grows as a result of this bubble, and the more painful it is when the air comes out” – Peter Schiff

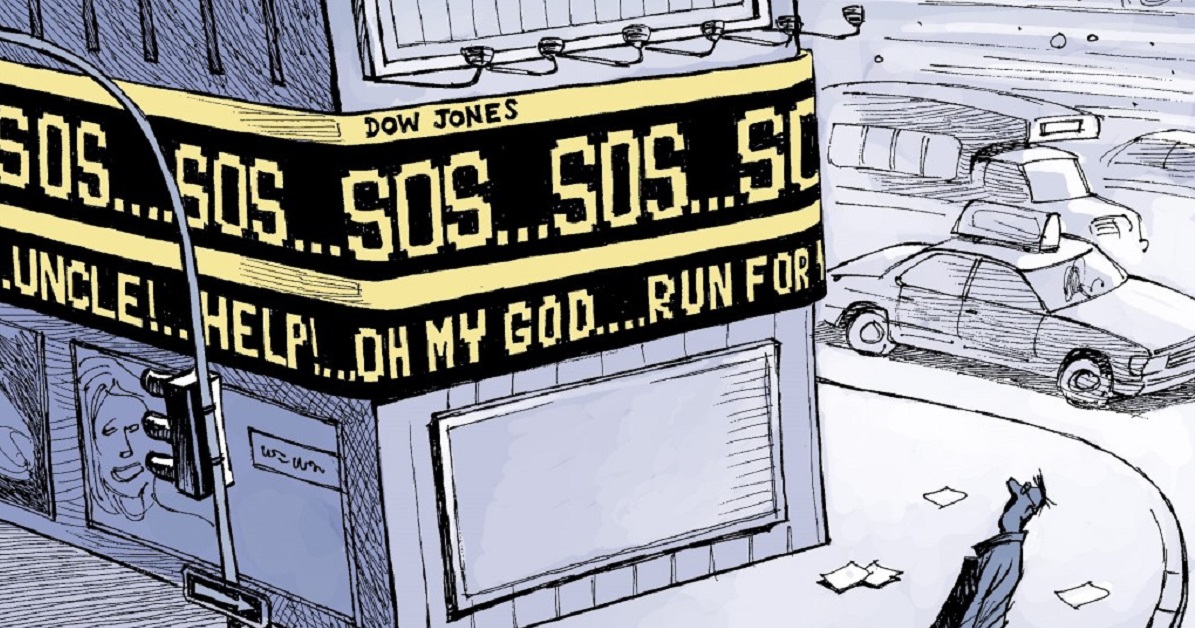

“The Fed inflated a much bigger bubble this time than it did last time. And yes, the longer we succeed in kicking the can down the road, the greater the imbalances grows as a result of this bubble, and the more painful it is when the air comes out. And that’s what’s going to happen. And what’s going to be so much worse about the coming recession is that it’s going to be inflationary. We’re going to have stagflation except it’s going to be a recession, not just stagnation, and the inflation rate is going to be far higher than it was the last time we had stagflation, which was in the 1970s” said Peter Schiff.

So Peter Schiff’s recession fated view is based on the Fed Chair Powell being powerless to prevent a recession in a backdrop of stagflation. Rough seas could be ahead.