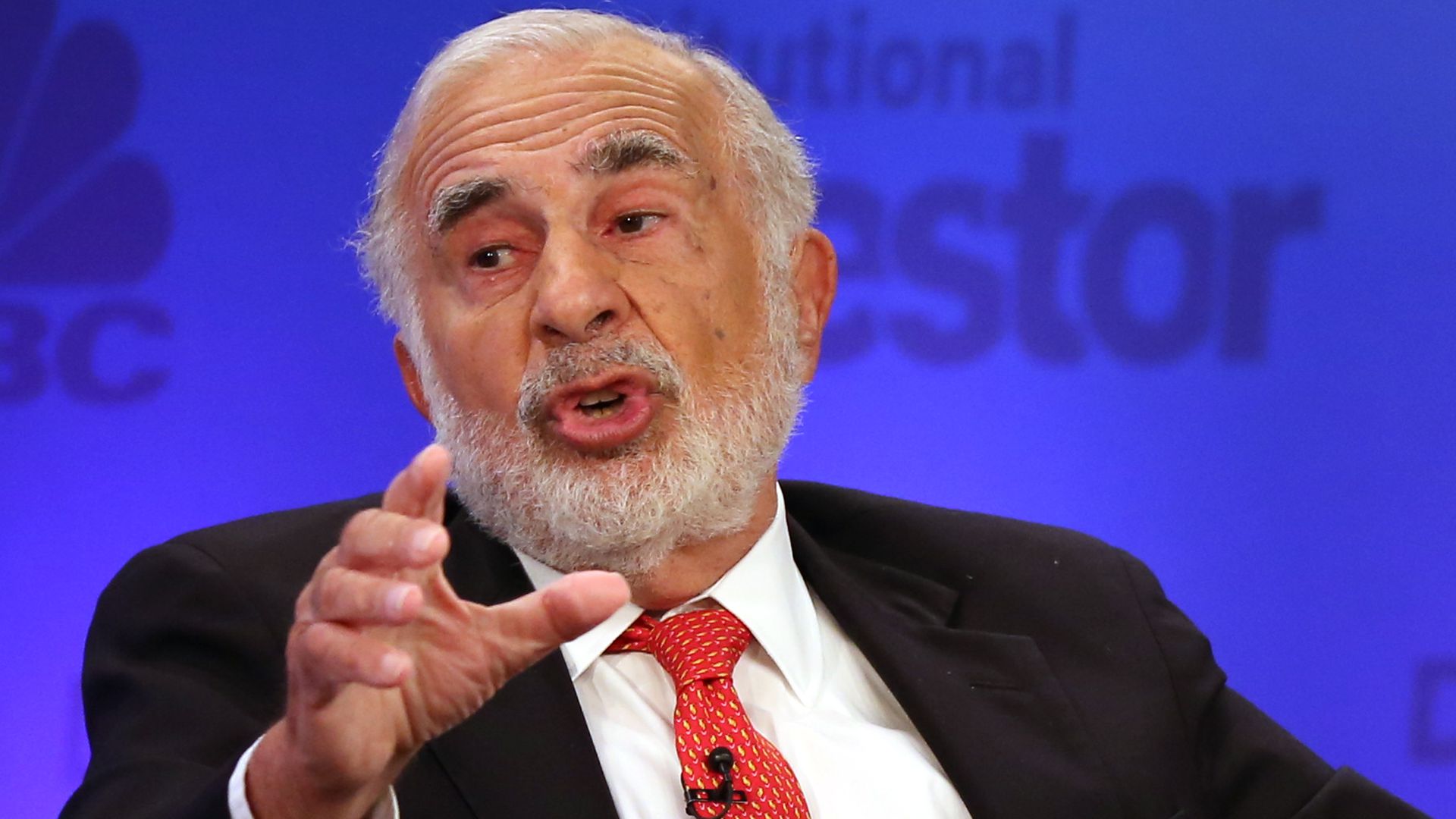

The Securities and Exchange Commission (SEC) fines Carl Icahn with multimillion-dollar disclosure fines.

These loans were secured using Icahn’s stake in Icahn Enterprises LP IEP as collateral.

The SEC wrote in a press release that Carl Icahn and IEP failed to “disclose information relating to Icahn’s pledges of IEP securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.”

The SEC argued Carl Icahn, the IEP’s controlling shareholder and Chairman of the board of directors of IEP’s general partner, pledged anywhere from 51% to 82% of IEP shares “as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.” The failure to disclose that fact to shareholders or federal regulators resulted in IEP and Icahn agreeing to pay $1.5 million and $500,000 in civil penalties.

“disclose information relating to Icahn’s pledges of IEP securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders”

SEC Press Release

Arguing the following the SEC fines Carl Icahn

“Notwithstanding Icahn’s various margin loan agreements and amendments, IEP failed to disclose Icahn’s pledges of IEP securities as required in its Form 10K until February 25, 2022. Carl Icahn failed to file amendments to Schedule 13D describing his personal margin loan agreements and amendments, dated back to at least 2005, and he failed to attach required guarantee agreements. Icahn’s failure to file the necessary amendments to Schedule 13D persisted until at least July 9, 2023,”Osman Nawaz, a senior SEC official, continued in his statement.

“The federal securities laws imposed independent disclosure obligations on both Icahn and IEP,” adding, “These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time.”

The SEC investigation began soon after short-seller Hindenburg Research released a short report on IEP in early May 2023. Shares of the company crashed in the days and weeks following the report.

“The federal securities laws imposed independent disclosure obligations on both Icahn and IEP”

Osman Nawaz, SEC

Hindenburg Research applauds as SEC fines Carl Icahn

In a scathing post on X, Hindenburg Research blasted Icahn for operating a Ponzi scheme, losing investors close to one billion dollars.

Posted X August 9

“Carl Icahn rightly got charged by the SEC for failing to disclose details of his massive margin loan. The company is still operating a Ponzi-like structure, as we alleged. Icahn Enterprises lost almost $1 billion last quarter alone yet is paying out a distribution equivalent to an annualized ~47% of its net asset value (NAV). The company trades currently at a ~88% premium to its reported NAV, even when ignoring its aggressive marks on its illiquid private investments. Rather than blame us for his investment failings, Icahn should put his money where his mouth is. Following our report, the company announced a $500 million buyback and has since bought back zero units. Instead, the company has sold $99 million of units through an at-the-market offering in the past two quarters, continuing to dump overvalued shares on unsuspecting retail investors. We remain short units of $IEP,” Hindenburg Research posted on X, dated August 9.