Carl Icahn‘s latest acquisition was revealed in a recent filing that the activist investor acquired 9.91% of Blue Airways Corp, a low-cost carrier.

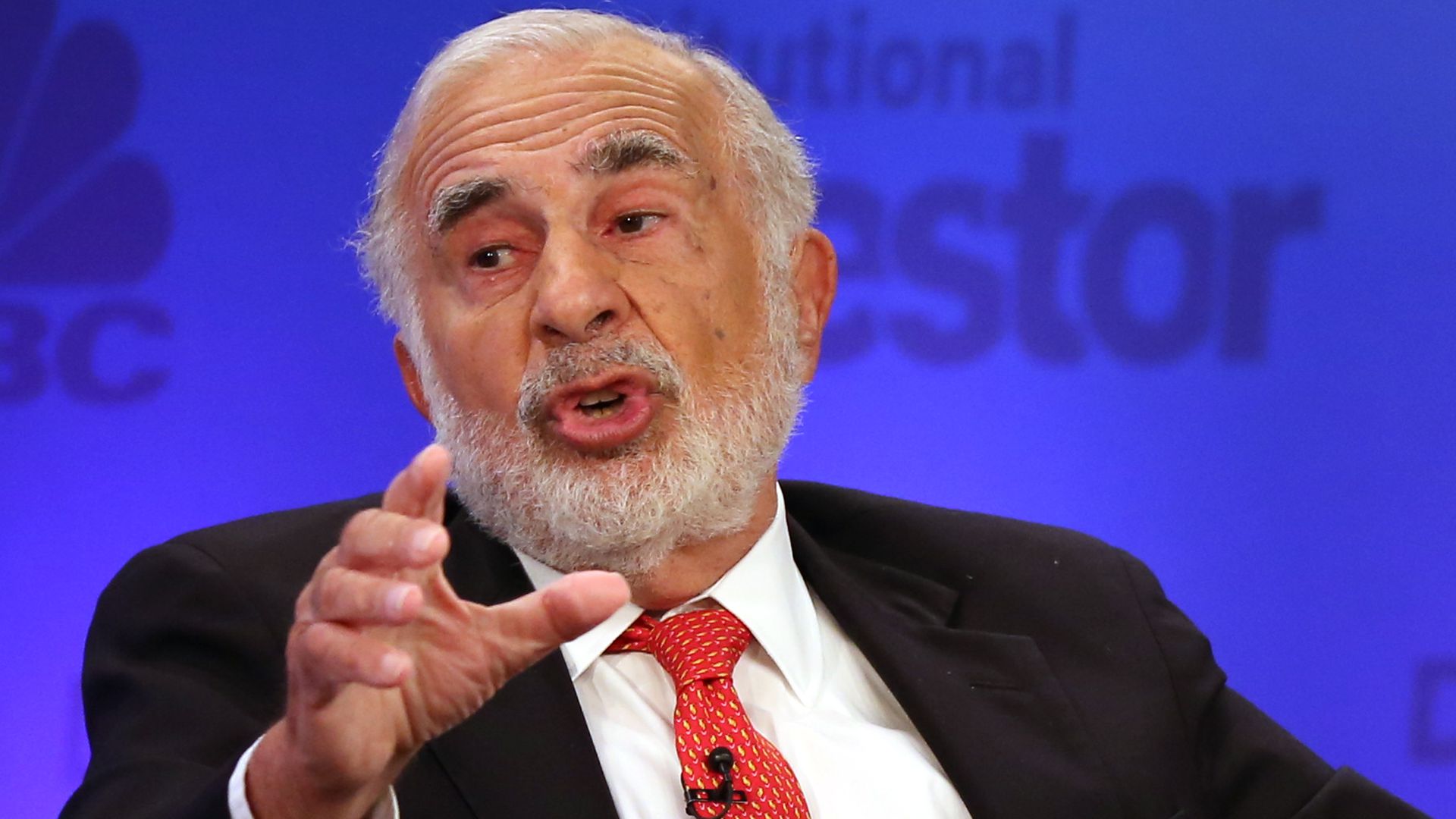

Carl Icahn is known as an activist investor, which is usually a specialized hedge fund, buying a significant minority stake in a publicly traded company to change how it is run.

Carl Icahn’s latest filing could be a heads-up for investors since when this well-known activist investor buys stocks in a company the stock tends to rise.

“Carl Icahn is known as an activist investor”

WEALTH TRAINING COMPANY

So Blue Airways Corp stock rose more than 14% in premarket trading in New York on news that Carl Icahn is acquiring a controlling interest in the low-budget airlines comes as no surprise.

“JetBlue was founded in 2000 on the mission of bringing humanity back to air travel. More than two decades later, the 6th largest airline in the United States is proud to Inspire Humanity through its distinctive product, culture and award-winning customer service,” according to the company’s website.

Carl Icahn’s latest acquisition of Blue Airways Corp amounted to 9.91% of the low-cost carrier which sent the stock into a double-digit rise in premarket trading in New York.

“Blue Airways Corp stock is undervalued and represents an attractive investment opportunity,” wrote Carl Icahn in a filing.

The filing continued: “The Reporting Persons have had, and intend to continue to have, discussions with members of the Issuer’s management and board of directors regarding the possibility of board representation.”

JetBlue stock experienced turbulence in recent years as the company lost many due to what it described as operational challenges.

Airlines are recovering from the post-global lockdown era, which grounded commercial airlines for months.

The new CEO, Joanna Geraghty, who will take up her post in February, has committed “aggressive action” to guide the airline out of financial turbulence and into blue skies of profitability.

“Blue Airways Corp stock is undervalued and represents an attractive investment opportunity”

CARL ICAHN

A spokesperson for JetBlue recently said;

“We are always open to constructive dialogue with our investors as we continue to execute our plan to enhance value for all shareholders and stakeholders.”

Carl Icahn’s latest acquisition of JetBlue comes one month after JetBlue’s failed takeover of Spirit Airlines.

A US District Judge ruled in favour to block the takeover, arguing that a merger would suppress competition. Spirit has since explored restructuring options.

Carl Icahn’s latest acquisition of JetBlue is the billionaire’s first public activist campaign since research firm Hindenburg Research aimed at his publicly traded firm, Icahn Enterprises, alleging it was overvalued and held assets at inflated prices.

Carl Icahn’s long history in the airline industry goes back to 1985 when he seized control of faltering TWA and dumped assets after TWA had years of turmoil.

Could Carl Icahn’s latest acquisition of JetBlue be a similar play four decades later?