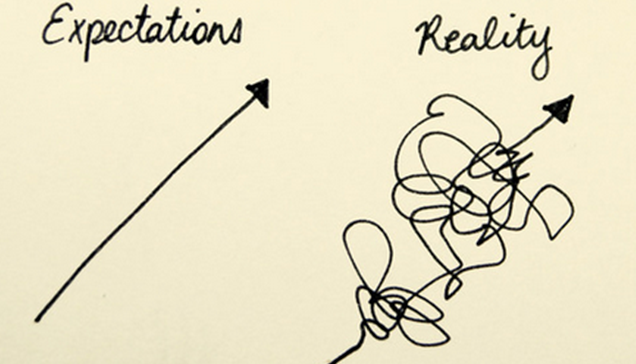

John Paulson‘s struggling hedge fund is the chatter of the hedge fund world and it also underscores the phrase written in fine print on all the investment marketing material that; “Past performance is no guarantee of future results.”

John Paulson’s struggling hedge fund comes in the wake of the greatest central bank monetary easing (fiat currency creating) experiment in the history of finance which spurred on a rabid bull market by default in stocks, bonds, real estate… For those in the know who bought the dip and rode the central bank’s money liquidity wave to the bank, the post-2008 financial crisis was a one-way bet.

“Past performance is no guarantee of future results”

Remember buy the BTFD free money scheme (scam) four years ago. “We can ignore reality, but we cannot ignore the consequences of ignoring reality” Ayn Rand. Can this fiasco continue for much longer?

But let’s keep it on the dollar, why is John Paulson’s struggling hedge fund even a story today, bearing in mind John Paulson call to fame was predicting the collapse in US subprime mortgages which triggered to 2008 financial crisis.

John Paulson rightly believed that lending to non-creditworthy mortgage lenders and bundle them together with other more credit worth lenders with an attractive red ribbon AAA credit rating would eventually rattle the credit market.

So John Paulson’s big short (which literally converted him from an obscure money manager into a financial legend) was to use credit default swaps to bet against the US sub-prime mortgage lending market. It was the biggest financial hauls in the industry’s history. Put another way John Paulson personally made $4bn from the financial crisis.

“We can ignore reality, but we cannot ignore the consequences of ignoring reality”

AYN RAND

But 2008 is a long time in the hedge fund world and today John Paulson’s struggling hedge-fund is what now occupies the news.

The great contrarian investor has been caught offside by a string of trades which have contributed to John Paulson’s struggling hedge-fund.

The string of losing trades that are adding to John Paulson’s struggling hedge fund in healthcare stocks, banks, and gold and by betting against German bonds.

One of his John Paulson’s most high-profile recent ill-fated investment was a big bet on drug-maker Valeant Pharmaceuticals Paulson & Co is the drugmaker’s single biggest shareholder, but the stock has collapsed from a high of $262.50 in 2015 to just $16.80 this week — a loss of more than 93 percent over the period.

Moreover, loss-making positions in an exchange-traded fund that tracks the price of gold are adding to John Paulson’s struggling hedge fund. The gold ETF has lost about 32 percent of its value since the hedge fund’s investment peaked at $4.6bn in 2011. Although John Paulson gold ETF investment is seeing some improvement in 2018. But the Paulson Partners Enhanced fund, which uses borrowed money to double down on its trades, sank 35 percent last year and about 49 percent in 2016, according to a person familiar with the matter.

However, it is the former star investor’s flagship merger arbitrage fund that has really added to John Paulson’s struggling hedge fund. Merger arbitrage is John Paulson’s specialty — losing 18.1 percent and 23 percent in 2016 and 2017, respectively, according to the performance update of a mirror fund offered by Schroders.

“One of John Paulson’s hedge funds has plunged about 70 percent over the past four years and the investor billionaire is plagued with investor redemptions”

So John Paulson’s struggling hedge fund has been hit with four consecutive years of losses and that has led to a sharp drop John Paulson’s struggling hedge fund asset under management. Paulson & Co’s assets have now shrunk to about $9bn, of which two-thirds is Mr. Paulson’s own money.

One of John Paulson’s hedge funds has plunged about 70 percent over the past four years and the investor billionaire is plagued with investor redemptions.

John Paulson’s struggling hedge fund has meant that the billionaire investor has been forced to rethink his fund’s strategy. Recently the hedge fund manager has let a number of employees go.

“We are right-sizing the firm to focus on our core expertise in areas that are growing” a spokesman for Paulson & Co said in a statement.

Investors who stuck it out in John Paulson’s oldest struggling hedge fund have lost about 42 percent of their capital over the past four years. The last two years have been the roughest: a 17 percent loss in 2017 and about a 25 percent drop the year before.

“We are right-sizing the firm to focus on our core expertise in areas that are growing” – Spokesman for Paulson & Co

John Paulson’s struggling hedge fund has also meant that the 62-year-old billionaire investor is now seeking big fees while investing his own money.

John Paulson had no other option but to invest his own money after most of his clients fled. The billionaire investor’s strategy to raise assets and generate big fees is at the risk of losing his own capital.

It is called first loss and it works like this; managers like Paulson put their own money into an account within a first-loss fund, and any of the three firms contribute nine times as much from their investors. Managers get to keep about 55 percent of the trading profits, more than double the standard industry cut. But should the strategy go badly wrong, all of the losses come out of their invested capital until it’s gone.

“The upside, if you do well, is good,” said Karl Cole-Frieman, whose law firm advises hedge funds on seeding deals and other structuring issues. “The downside, if you do poorly, is disastrous.”

First-loss funds were pioneered by Norwalk, Connecticut-based Top water, which was co-founded in 2002 by Bryan Borgia and Travis Taylor in an 800 square-foot space above a pizzeria.

John Paulson’s struggling hedge fund isn’t a unique story. Many of the money star performers who predicted the 2008 crisis have been caught out by the central bank’s ability to do whatever it takes to keep this fake bull market running.

Just like Crispin Odey who is short gilts so too John Paulson is aiming to turn around the fortune of his struggling hedge fund by shorting the bond market again. Whats more, this time the great bears are all skin in the game. But until investors have no real alternative the central banks can keep markets irrational longer than investors (including billionaire investors) can stay solvent. Stay tuned.