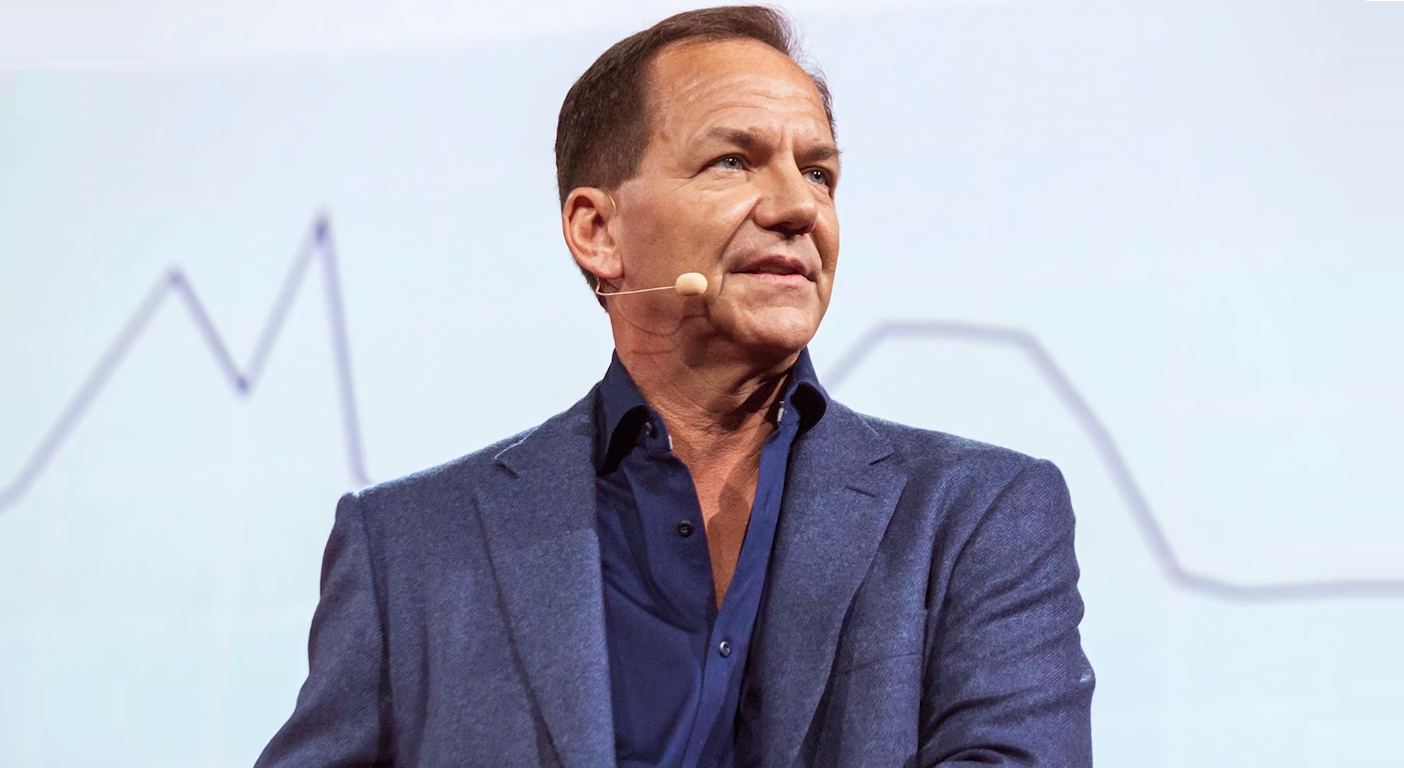

Paul Tudor Jones frets over US national debt, which is fast approaching 35 trillion dollars, source US Debt Clock.

Paul Tudor Jones recently coined the national debt, a debt bomb where just the interest payments on the 34 trillion dollars have exceeded one trillion dollars per year, which nears defence and Medicare costs.

Persistent inflation underscores the rationale for Paul Tudor Jones’s fret over the US national debt.

National debt becomes more burdensome when interest rates remain relatively elevated, especially if there has been a spending debt binge.

In the wake of the 2020 lockdowns, the national deficit inverted along with government spending.

But when the Fed fund rates were near zero interest rate during the 20s, along with bond yields, servicing debt was a breeze.

“Persistent inflation underscores the rationale for Paul Tudor Jones’s fret over the US national debt”

WEALTH TRAINING COMPANY

Near-zero interest rate policy of almost a decade since the last 2008 financial crisis aided and abetted a debt bomb that Paul Tudor Jones frets over

Financing a 34 trillion dollar national debt is not so burdensome when the Fed is accommodating with near-zero interest rate policy and buying the bonds, known as quantitative easing policy, to suppress the yields.

But when those treasury bonds mature, a new batch is issued with higher yields, servicing the multi-trillion dollar debt could be the straw that breaks the camel’s back.

Paul Tudor Jones frets over US national debt, which reaches one trillion dollars in debt every three months

What happens when the interest rate payments on the national debt exceed all spending on the budget items, such as Medicare, Social Security and Defence combined?

During the late 70s stagflation, the Fed fund rates hit a record 20%.

“During the late 70s stagflation, the Fed fund rates hit a record 20%”

WEALTH TRAINING COMPANY

If the fed fund rate rose to such a level today along with bond yields, the government would borrow four times as much to pay interest on the debt, making servicing the national debt the main budget item.

It would be a hopeless case.

So Paul Tudor Jones recently sounded the alarm about the looming threat of America’s debt bomb reaching a critical juncture.

Paul Tudor Jones frets over the US national debt that has become the propeller driving the economy

In a February, Paul Tudor Jones underscored the current strength of the US economy but cautioned that it is propped on extensive government borrowing and spending

The US still has a market economy with a private sector many times larger than the public sector.

“At $21.6 trillion, the private sector is over 4.5x the size of the public sector and 44.5x bigger than the philanthropic sector” – Paul Tudor Jones

“At $21.6 trillion, the private sector is over 4.5x the size of the public sector and 44.5x bigger than the philanthropic sector,” Xed Paul Tudor Jones, in March 2023.

But Paul Tudor Jones reiterated that the burgeoning debt issue would inevitably impact the market sooner or later.

Indeed, with the national debt surpassing a staggering $34 trillion, the Fed fund rates stuck at 5,5% and the US 10-year treasury bond yield at 4.6%, which all equals significant interest payment obligations.

The Congressional Budget Office (CBO) reported a sharp increase in net interest payments on the debt, soaring from $223 billion in fiscal year 2015 to $659 billion in fiscal year 2023.

Projections for the fiscal year 2024 indicate that net interest payments could reach $870 billion, surpassing the expenditures on national defence and Medicare, making it the second-largest budget item behind Social Security.

Paul Tudor Jones frets over US national debt and is an advocate of thoughtful deficit reduction to mitigate interest costs

Unrestrained debts have led to a disequilibrium in the bond market, with the supply of bonds exceeding investor demand.

Persistent inflation and the Fed’s attempts to tackle it with higher interest rates and quantitative tightening created the dynamics for the worst bond market crash in the history of finance, slashing trillions of dollars off the book value of bonds.

A banking liquidity credit squeeze followed, and five banks collapsed in 2023.

“Generations of investors perceived treasury bonds as a safe haven asset”

– Wealth Training Company

Paul Tudor Jones frets over US national debt, which weighs on treasury credit rating

In August 2023, Fitch Downgrades the US’ Long-Term Ratings to ‘AA+’ from ‘AAA’; Outlook Stable.

“The downgrade reflects concerns about the growth of the government’s debt and the ability of Congress and the administration to control spending,” Fitch wrote in 2023.

Fast forward a year, and the national debt has added a few more trillion dollars, posing a threat to the domestic and global economy.

Generations of investors perceived treasury bonds as a safe haven asset.

The maturity risk of holding bonds was not factored into the equation since the US dollar is the world reserve currency, and inflation, up until recently, was relatively stable.

The risk of undermining treasury bonds as a haven asset, a good store of value, pledged by commercial banks as collateral to underwrite loans could also trigger a massive global credit squeeze.

In such a scenario, everything could get sold or liquidated as banks raise liquidity.

If investors are highly leveraged, massive margin calls could trigger a tsunami of selling orders in a down market, causing the markets to spiral further.

Paul Tudor Jones frets over US national debt, but what is the solution?

Some believe to tackle this issue effectively, a multifaceted approach is necessary.

Some argue for targeted spending cuts, revenue-raising measures, and structural reforms to entitlement programs. Fiscal spending should be made for strategic investments in infrastructure, which would foster economic growth.

Education and innovation could also boost revenue and alleviate the debt burden.

The challenge to enacting such reforms in a polarized political landscape is avoiding a gridlock.

Ideally, fiscal responsibility to tackle a mounting debt crisis might receive bipartisan cooperation and a commitment to fiscal responsibility to ensure long-term prosperity of the nation.

Paul Tudor Jones forecasted turbulence in the bond market, which could be why he frets over US national debt

“And you’re going to have this just massive boom. And the consequences of that, I think, are pretty clear for fixed income. Fixed income will probably go down during that. Commodities will probably go up,” he wrote in the lockdowns.