The firm was founded in 1982 by James Simons, an award-winning mathematician, and former Cold War code breaker.

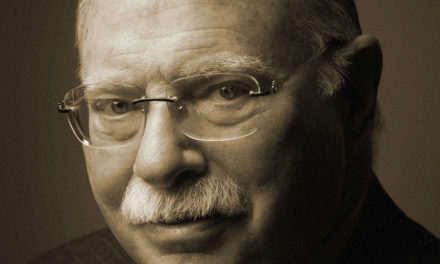

Peter Brown has been leading the firm on a day-to-day level ever since Renaissance founder James Simons retired in 2010.

Peter Brown worked as language technology expert at IBM before joining Renaissance in 1993.

He wrote a computer program to seat people at his wedding and has ridden a unicycle in the office. Peter Brown is the son of Henry Brown, who invented the money-market fund.

Peter Brown earned a Doctorate, Carnegie Mellon University; Bachelor of Arts / Science, Harvard University.

Peter Brown is a quantitative trader co-chief executive of $36 billion Renaissance Technologies, the most successful quantitative hedge fund in history

INVESTMENT STYLE

Peter Brown is a systematic trading. He uses complex quantitative models derived from mathematical and statistical analyses.

Renaissance Technologies is unique, even among hedge funds, for the genius and eccentricities of its people

LEARNING RESOURCES

For outsiders, the mystery of mysteries is how Medallion has managed to pump out annualised returns of almost 80 per cent a year, before fees. Even after all these years they’ve managed to fend off copycats” says Philippe Bonnefoy, a former Medallion investor.

Understandably Peter Brown and Renaissance Technologies keep their trading secrets to themselves!

The mystery of mysteries is how Medallion has managed to pump out annualised returns of almost 80 per cent a year, before fees

CONNECT WITH INVESTOR

Follow this World Top Investor via their various social media channels and read more about their background and current investment interests on their official website:

Peter Brown

www.rentec.com