Sam Zell shelves real estate acquisitions, despite mounting waves of distressed properties hitting the market.

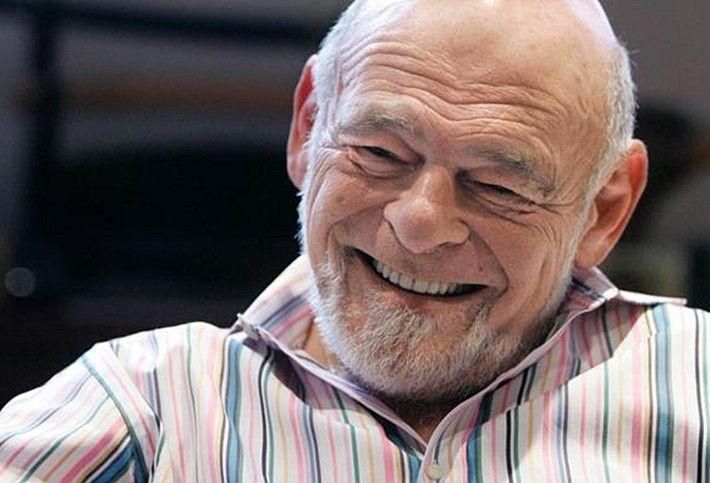

For those unfamiliar with the name Sam Zell, is a self-made American billionaire businessman, with investments in commercial real estate, energy, manufacturing, logistics/transportation, healthcare, and communications. Sam Zell is chairman of Equity Group Investments (EGI), the private investment firm he founded in 1969.

Sam Zell’s big fortunes were made primarily by snapping up distressed real estate property in previous recessions.

“Sam Zell shelves real estate acquisitions, despite mounting waves of distressed properties hitting the market”

WEALTH TRAINING COMPANY

Sam Zell is known as the “grave dancer” for his uncanny knack of acquiring real estate bargains then selling them for huge profits years later

Indeed, the 79-year-old billionaire investor made a fortune buying distressed real estate.

But in the current real estate downturn, particularly commercial real estate Sam Zell shelves real estate acquisitions

The current supply of distressed commercial real estate is mushrooming, as in most previous recessions.

Roughly $430 billion of commercial real estate debt comes due this year, out of $2.3 trillion that matures for the next five years, according to Morgan Stanley

What’s more, commercial real estate is particularly vulnerable to the digitalization of everything, the Amazon effect of retail, which caused brick and mortar meltdown. Moreover, the pandemic lockdowns have also accelerated the use of digital meet and greet platforms, which is having an impact on business travel and hotels.

“the 79-year-old billionaire investor made a fortune buying distressed real estate”

WEALTH TRAINING COMPANY

Sam Zell shelves real estate acquisitions, but the real-estate mogul didn’t always play it that way

In fact, during the early stage of the 2020 pandemic lockdowns, Sam Zell did what he normally doesn’t do, which is follow the herd and by distressed real estate.

So, his most notable real estate deal during the coronavirus pandemic period came last month when one of his companies agreed to pay about $3.4 billion for Monmouth Real Estate Investment Corp. It was not exactly a distressed deal, bearing in mind Monmouth owns 120 industrial properties in 31 states. The sector is one of the most profitable due to buoyant demand for fulfillment centers from e-commerce companies such as Amazon.com Inc.

However, Sam Zell was unable to drive as hard a bargain as he had in many previous distressed deals. The all-stock deal reached in May was valued at more than $18 a share, which is a near-record for Monmouth stock. Sam Zell might even have to pay more, since Blackwells Capital, which made an $18-a-share all-cash bid late last year, said it is weighing options including a higher offer.

“This is by far the most active distressed and opportunistic market for commercial real estate that I’ve seen in my 15-year career” – Adam Sklar

Perhaps Sam Zell’s commercial real estate acquisition during the pandemic is a heads up for commercial real estate’s future in the reset, a fulfillment center for e-commerce

Commercial real estate which can be converted into affordable housing could be another use for dwindling demand for commercial real estate.

Land is a valuable finite resource, particularly in climate change where more regions are being designated flood zones and not suitable for human habitation.

But during this transitional period, I see commercial real estate in turmoil with a snapshot of the landscape in disharmony. For example, Regional Malls are experiencing 15.71% of loans in distress, Retail is posting 9.37% in distress. Regarding Hotels, it is even bleaker with 16.3% Hotel loans in distress in March, according to FitchRatings, May 2021.

So, since Sam Zell’s $3.4 billion for Monmouth Real Estate Investment Corp in May Sam Zell shelves real estate acquisitions despite mushroom distressed commercial real estate.

Sam Zell’s move is out of lockstep with other dominant investors

“This is by far the most active distressed and opportunistic market for commercial real estate that I’ve seen in my 15-year career” said Adam Sklar, a portfolio manager at Monarch Alternative Capital, whose $9 billion funds specialize in those strategies.

Sam Zell’s strategy to hold out on real-estate deals could signal that the best of distressed bargains has yet to come in the pandemic lockdowns

Sam Zell described the retail real estate as a “falling knife”—investors who think they are getting a bargain might end up getting bloody themselves. Prices haven’t fallen enough in the sectors that are getting beaten up, he said.

“There is going to be an opportunity in retail. I just don’t think it’s here yet” – Sam Zell

“There is going to be an opportunity in retail. I just don’t think it’s here yet” he said. He added that hotels also look expensive: “I can’t relate…pricing to the way I see opportunity” he said.

But the Fed, the biggest buyer of distressed assets with its non-stop 120 billion dollars asset purchases of bonds per month is impossible to compete with.

The Fed’s unprecedented monetary policy is slowly eliminating distressed debts from the system.

In other words, Sam Zell shelves real estate acquisitions, believing the best has yet to come. But my take is that the best will never come because the Fed could be wrecking yet another logical opportunistic play with its unlimited monetary cannon buying and owning every distressed asset in what increasingly has the look and feel of a planned economy.

While hotels, malls, and other properties have suffered enormous declines in revenue.

So far, few owners have been forced to sell at steep discounts due to government stimulus programs bankrolled by the Fed’s easy money policy which kept a lid on foreclosure

But with the World health authority now assigning Greek letters to the variants of the virus mutating that could be the greatest clue to standby for more pandemic lockdowns.

In other words, we see more quantitative easing playing out going forward, something way north of 120 billion dollars of asset purchases per month by the Fed.

Moreover, The Fed’s western aligned sidekicks, the BoJ, ECB, BoE are all likely to follow suit in a QE infinity type of melt-up.

But don’t worry, in the Great Reset, you will own nothing and be happy.

The State will provide all your needs and even vaccinate you for free.

What could possibly go wrong?