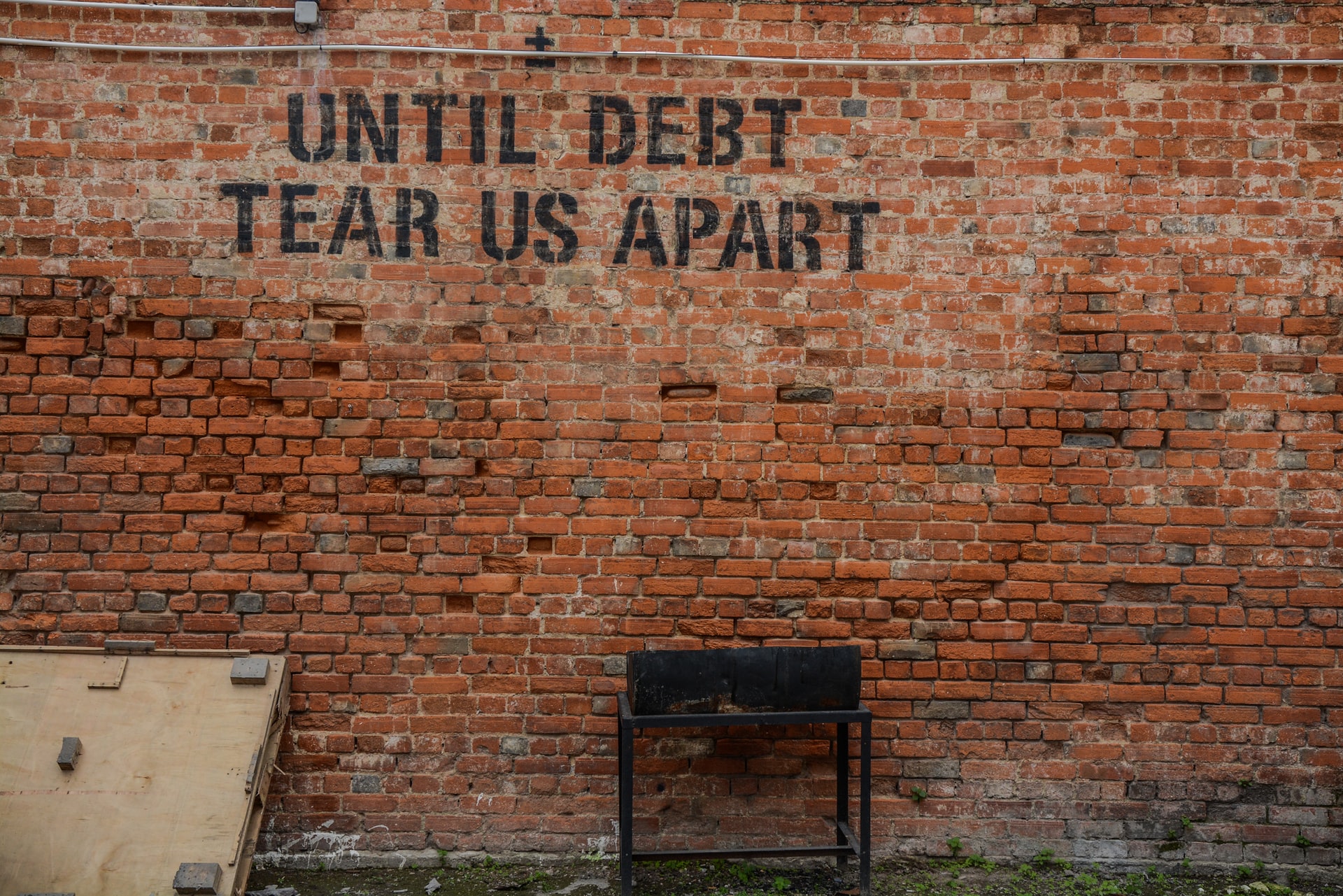

Jim Rogers lays out his survival plan for the unavoidable day of debt reckoning.

“In 2008, we had a big bear market because of too many debts everywhere,” said Jim Rogers.

Debts have skyrocketed in the US and everywhere, particularly in Europe and China. Jim Rogers noted that China, which had little debts 25 years ago, is burdened with debts today. “Everyone today has gigantic amounts of debts,” he said.

“In 2008, we had a big bear market because of too many debts everywhere”

JIM ROGERS

Unsustainable global debt; Jim Rogers lays out his survival plan

“I am just telling the simple facts; we had a bad time in 2008, and since then, debt has skyrocketed,” he said.

Jim Rogers notes that the 34 trillion US dollar public deficit is the on-balance sheet amount. Off-sheet balance amount of unfunded liabilities, social security payments, pensions etc., could be in the vicinity of 200 trillion US dollars.

Fed Chair Powell has publicly admitted that exponential debt growth is unsustainable.

Keep eyes peeled for a massive shock; Jim Rogers lays out his survival plan

He noted the catalyst is typically something big in a place nobody is looking at.

Is Irland going bankrupt?

“I am just telling the simple facts; we had a bad time in 2008, and since then, debt has skyrocketed”

JIM ROGERS

“I am not suggesting that will happen. In 2007 it was Iceland. Most people didn’t know there was an Iceland, much less that it could go bankrupt,” he said.

Jim Rogers recalls the events leading to the 2008 financial crisis.

“A few weeks later, it was Bear Stearns then Northern Rock in the UK. A few weeks later, Lehman Brothers, and by then, it was on the evening news. It started a year before in Iceland, of all places,” he said.

The financial Butterfly effect.

“I am lazy, and I do not like trading. I want to own things for a long time”

– Jim Rogers

We don’t know where it will occur or when, but it will happen. It is going to happen.

“I don’t know when they will ring the bell and say okay guys, it is over,” he said.

Perma Gold Bug remains conservative, Jim Rogers lays out his survival plan

” I don’t have many equities that I own these days. I own a few commodities, gold and silver, which I hope to pass on to his children,” he said.

“I am not selling short because often, in the last few days, you have a huge blowoff. In 1999, NASDAQ doubled in six months. People go nuts.

When everyone wants to play the game because they think it is so easy to make money, it is time to leave the party,” he said.

His success has been finding things cheap where positive change takes place. “I am lazy, and I do not like trading.

I want to own things for a long time,” he said.

Jim Rogers lays out his survival plan, precious metals

He doesn’t have confidence that central bankers will get it right but notes they have so much power they can print endless amounts of money.

I don’t have long-term confidence. The first two central banks disappeared, and the third will disappear.

The last time this happened was when the GBP lost its status, and USD was rising to take its place. He doesn’t know this time what will replace the USD.

When things go bad, better have some precious metals stacked away.

He plans to sell short in the foreseeable future.