The Windsor Fund became the highest returning, and subsequently largest mutual fund in existence during Neff’s management returning 13.7% annually versus 10.6% for the S&P 500.

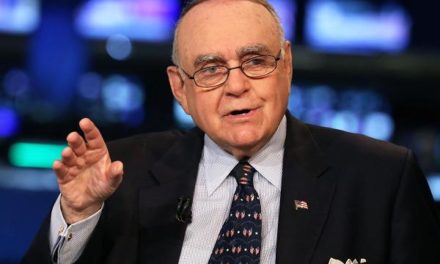

John Neff graduated from at the University of Toledo in 1955. He also attended the Business school of Case Western Reserve University, graduating in 1958.

John Neff started his career working for the National City Bank of Cleveland.

In 1964, he joined the Wellington Management Co. (a sub-advisor to the Vanguard group of funds). After three years at the company, he was appointed portfolio manager of Windsor, Gemini, and Qualified Dividend funds.

John Neff eventually retired in 1995.

The Windsor Fund became the highest returning, and subsequently largest mutual fund in existence during John Neff’s management

INVESTMENT STYLE

John Neff is a contrarian value investor who doesn’t see any benefit playing it safe and over diversifying to mediocre returns, as many proponents of modern portfolio theory advocate.

“Sticking our neck out worked for Windsor” said Neff.

John Neff has referred to his investing style as a low price-to-earnings (P/E) methodology, though others consider Neff a variation of the standard value investor.

He is also considered a tactical contrarian investor. Neff’s investment approach entails low-tech security analysis which involves digging into a company and its management and analyzing the books.

For John Neff, ROE (return on equity) is the single best measure of management effectiveness.

Moreover, Neff places emphasis on predicting the economy and projecting a company’s future earnings. Neff favors stocks where dividend yields are high, in the 4% to 5% range.

Some of John Neff’s quotes follows;

“An early Greek philosopher, Heraclitus, observed that a person cannot step twice into the same river because that river changes constantly. Nor, in the same sense, can an investor step twice in the same market, because the market changes constantly.”

“My inclinations to buy out-of-favor stocks come naturally but by itself doesn’t account for beating the market. Success also required lots of perseverance. You have to be willing to hang in when prevailing wisdom says you’re wrong. That’s not instinctive; more often than not, it goes against instinct.”

Sticking our neck out worked for Windsor – John Neff

LEARNING RESOURCES

“John Neff on Investing” published on October 22, 1999, provides a valuable insight into Neff’s underlying contrarian strategies which are timeless.

John Neff’s book covers his childhood and early investment career which eventually led to him taking the helm at Windsor in Philadelphia.

My inclinations to buy out-of-favor stocks come naturally but by itself doesn’t account for beating the market. Success also required lots of perseverance. You have to be willing to hang in when prevailing wisdom says you’re wrong. That’s not instinctive; more often than not, it goes against instinct – John Neff

CONNECT WITH INVESTOR

Follow this World Top Investor via their various social media channels and read more about their background and current investment interests on their official website:

John Neff

https://en.wikipedia.org/wiki/John_Neff

World Top Investors Rating

86%

Summary Crunching the numbers we find out just where this investor stands in the rankings for the Worlds Top Investors!